Purpose

The purpose of this Quick Reference Guide (QRG) is to provide an explanation of how Indirect agencies (Interface-Only) will be impacted by the upgrade from R1 to R3 of NCFS. It will cover the differences to expect while entering daily cash transactions: certificates of deposit, requisitions for payment, and transfers of funds.

Introduction and Overview

This QRG provides a high-level review of the two methods of manually entering your daily cash transactions, with focus on account distributions:

- Enter journals through General Accounting Journals app

- Enter transfers through Intercompany Accounting Transactions app

Users, primarily direct agency users, will see values in some of the currently unused segments (ex: Agency Management Unit, Agency Program, Funding Source, Project).

All users, both direct and indirect, will see a great many more values to choose from in the Budget Fund and Account segments!

Although direct agency users will be required to obtain an approval from someone at their agency before the transaction is routed to OSC Central Compliance or DST, indirect agency users will not be utilizing the agency-level approval feature for their daily cash transactions.

This QRG does not cover how month end processes are impacted. A separate document on month end interfacing, reconciliation, and certification will be provided by OSC NCFS Team.

User Tip

For indirect agency users, the exact same accounting distributions are keyed in both Release 1 (R1) and Release 3 (R3) versions of NCFS.

R3 Chart of Accounts – Impacts Comparison

| Segment Name | Indirect Organizations | Direct Organizations | Comments |

|---|---|---|---|

| Agency | Same as R1 | Same as R1 | No change from R1 |

| Budget Fund | Continue to use clearing Budget Code values (first digit is zero) |

Begin using true (non-clearing) Budget Fund values. Discontinue use of clearing Budget Code values |

List of value choices has greatly increased! Each direct agency has been assigned a unique range of Budget Fund values. |

| Account |

Only 3 values are to be used:

|

Begin using true (non-clearing) Account values Discontinue use of clearing Account values |

List of value choices has greatly increased! Take care to select the correct value! |

| Agency Mgmt Unit | Accept default of zeros | Override default of zeros, as needed | List of value choices has increased |

| Agency Program | Accept default of zeros | Override default of zeros, as needed | List of value choices has increased |

| Funding Source | Accept default of zeros | Override default of zeros, as needed | List of value choices has increased |

| Project | Accept default of zeros | Override default of zeros, as needed | List of value choices has increased |

| Inter Fund | Accept default of zeros | Override default of zeros, as needed | List of value choices are the same for Agency segment |

| Future 1 | Accept default of zeros | Accept default of zeros | No change from R1 |

| Future 2 | Accept default of zeros | Accept default of zeros | No change from R1 |

| Future 3 | Accept default of zeros | Accept default of zeros | No change from R1 |

Enter Journals through Journals App

To enter journals in NCFS, please follow the steps below. There are 5 steps to complete this process.

Step 1. Log in to the NCFS portal with your credentials to access the system.

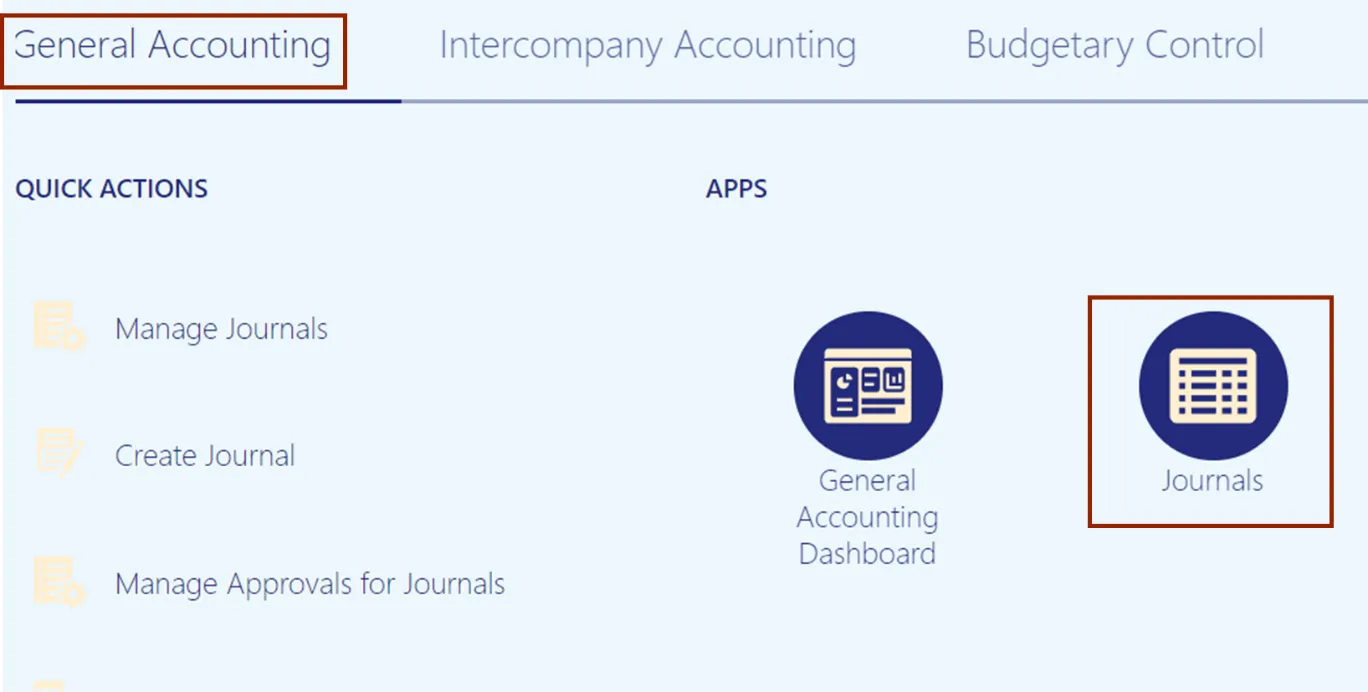

Step 2. On the Home page, click the General Accounting tab. Click the Journals app.

Step 3. Click the Tasks icon and select Create Journal or Create Journal in Spreadsheet.

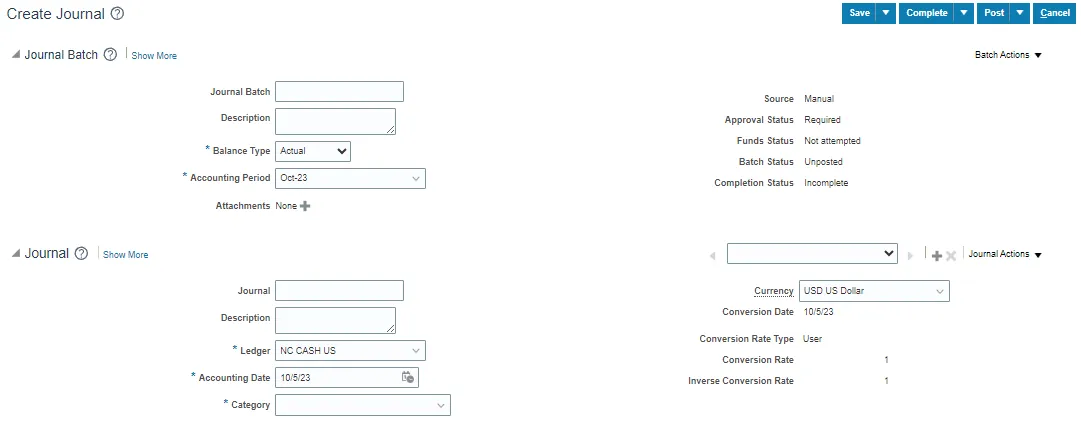

Step 4. Enter Batch and Journal header fields (see QRG GL-02 for step-by-step instructions).

Step 5. Enter Journal Line fields (see QRG GL-02 for step-by-step instructions).

Example of Deposit: Category = DEP – CASH & CHECK*

*Category choice list of values has increased from R1, specifically for use with non-cash journals.

Note: As in R1, each cash line must contain a "Type" value, e.g., DEP - Cash & Check AND a valid bank account DFF.

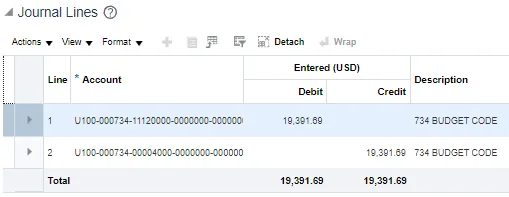

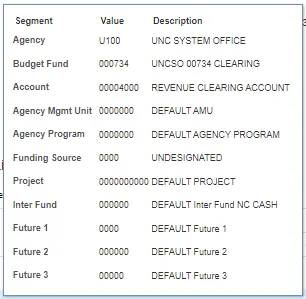

Expanded account distributions:

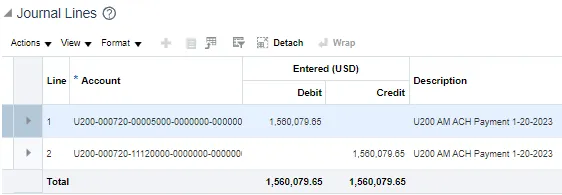

Example of Payment requisition: Category = PAY-6-GENERAL EXPENSE*

*Category choice list of values has increased from R1, specifically for use with non-cash journals.

Note: As in R1, each cash line must contain a "Type" value, e.g., DEP - Cash & Check AND a valid bank account DFF.

Expanded account distributions:

Enter Transfers Through Transactions App

To enter transfers in NCFS, please follow the steps below. There are 5 steps to complete this process.

Step 1. Log in to the NCFS portal with your credentials to access the system.

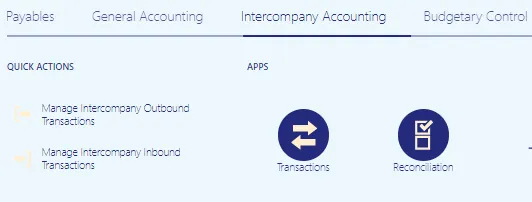

Step 2. On the Home page, click the Intercompany Accounting tab. Click the Transactions app.

Step 3. Click the Tasks icon and select Create Transaction or Create Transactions in Spreadsheet.

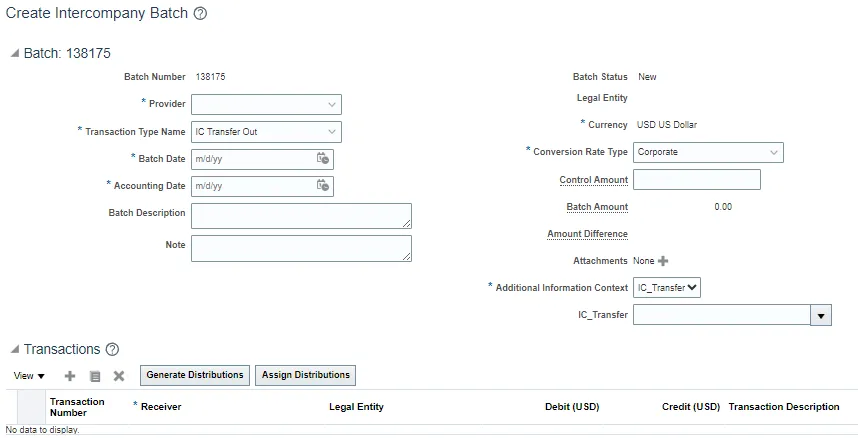

Step 4. Enter Batch and Transaction fields (see QRG ICT-01 for step-by-step instructions).

Step 5. Enter the Transaction Distributions fields (see QRG ICT-01 for step-by-step instructions).

Example of Internal Transfer: IC_Transfer = TF-8-INTERNAL ACROSS BUDGET CODES

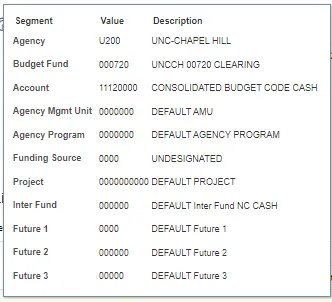

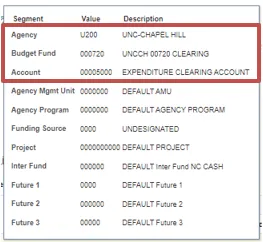

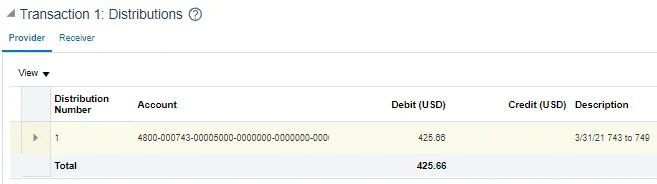

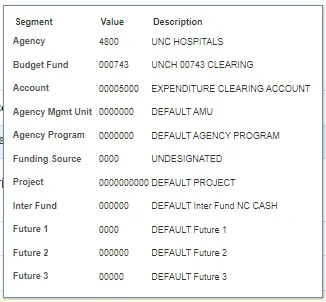

Provider Expanded Account Distribution:

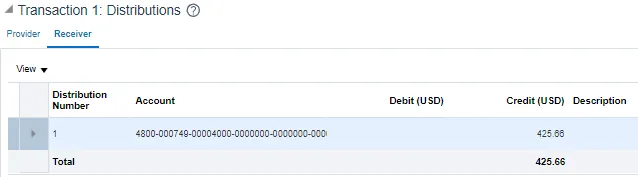

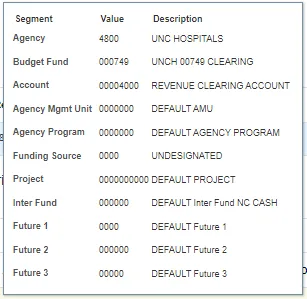

Receiver Expanded Account Distribution:

Wrap-Up

For daily cash transactions, indirect organization users should continue to use the same exact account distribution values as used in R1. With the implementation of R3, additional values will be available in numerous choice lists, such as journal Category, Budget Fund, and Account. To minimize data entry errors, awareness of these additional values is important to indirect organization users. For example, be sure to select 11120000 (NOT 11112000) for cash.

Additional Resources

- Virtual Instructor-Led Training (vILT)