Purpose

The purpose of this Quick Reference Guide (QRG) is to explain how to navigate to and generate the Deposits Report in the North Carolina Financial System (NCFS).

Introduction and Overview

This Quick Reference Guide covers the navigation to the Deposits Report and how to generate the report output. The Deposits Report provides information regarding posted and unposted deposit entries for the day by journal batch, budget code, and agency. The purpose of this report is to provide two views (Summary and Detailed) of the cash deposits daily. The summary tab provides a summary of deposits posted for the period selected by Budget Code Type. The Deposit Details tab provides detailed information about deposits based on period and Journal Status selected. Users also are able to add this report as a favorite in NCFS which makes it readily available and eliminates the navigation path.

User Tip

All first-time users should ensure at log-in that the browser cache is empty prior to initiating the log-on sequence.

Navigating to the Deposit Report

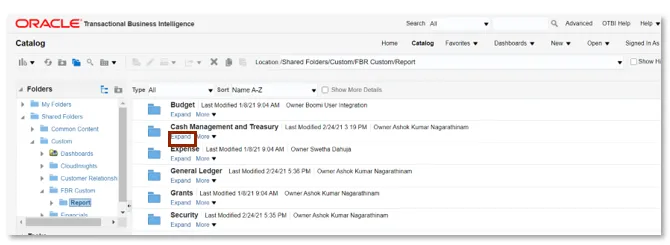

To navigate to the Deposits Report, please follow the steps below. There are 5 steps to complete this process.

Step 1. Click Expand in the Cash Management and Treasury Section.

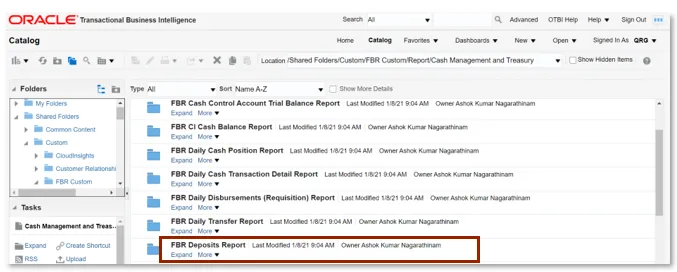

Step 2. Scroll down and click Expand under the FBR Deposits Report.

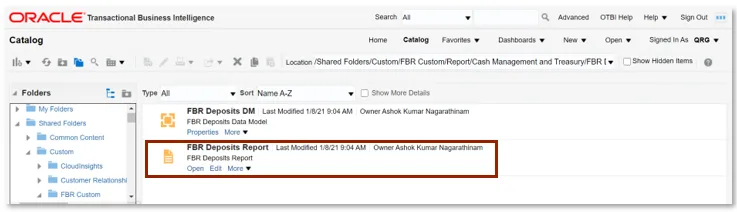

Step 3. Click Open under FBR Deposits Report.

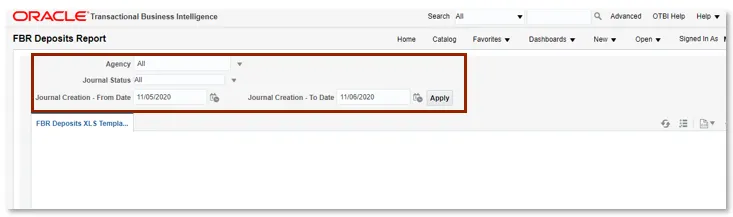

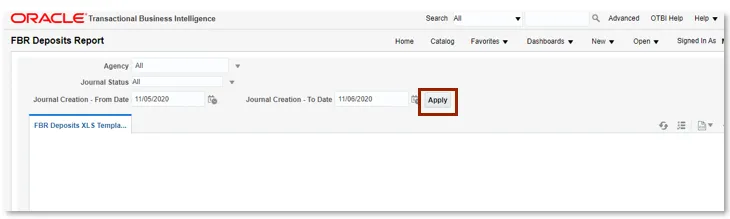

Step 4. Select the desired Agency, Journal Status, and Date.

User Tip

The Journal Status parameters allow users to see all unposted and posted transactions.

Step 5. Click Apply to run the Deposits Report.

Deposits Report Output

To navigate to the Deposits Report output, please follow the steps below. There are 3 steps to complete this process.

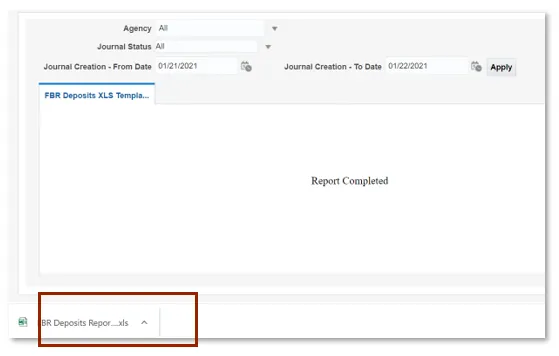

Step 1. In the bottom left-hand corner, click the Microsoft Excel Document.

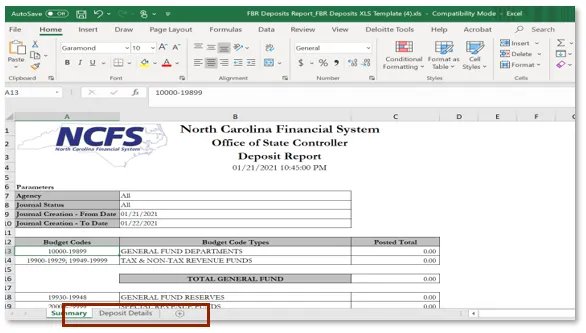

Step 2. Users can click the Summary or Deposit Details tabs.

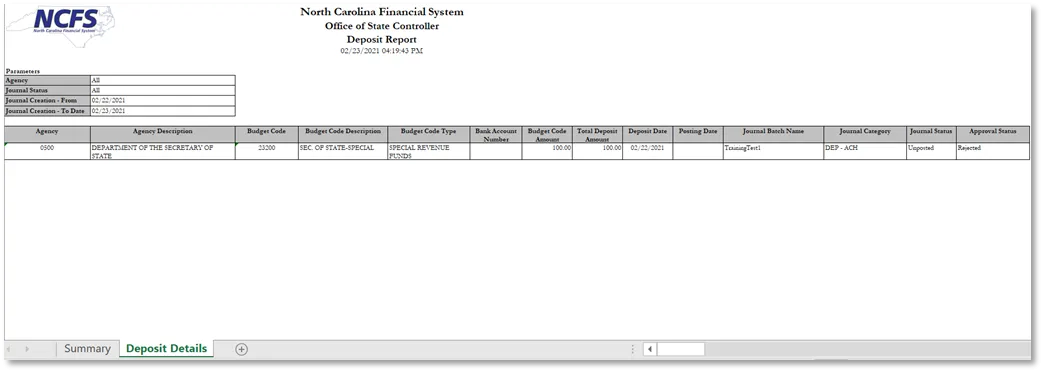

Step 3. The Deposit Details tab is pictured below.

| Report Field Name | Report Field Description | |

| Agency | This field displays the agency number. | |

| Agency Description | This field displays the Agency Name. | |

| Budget Code | This field displays the agency budget code for the transaction displayed. | |

| Budget Code Description | This field displays the budget code title. | |

| Budget Code Type | This field displays the budget code type such as General Fund Department, Special Revenue, etc., based on the criteria outlined on the Summary tab. | |

| Bank Account Number | This field displays the Bank Account Number associated with the organization Budget Code. | |

| Budget Code Amount | This field displays the Debit – the Credit of the cash account in the journal line. | |

| Total Deposit Amount | This field displays the total amount of the deposit for this journal batch. | |

| Deposit Date | This field displays the accounting date that is entered when creating the journal entry. | |

| Posting Date | This field displays the date the transaction was posted in the NCFS system. | |

| Journal Batch Name | This field displays the journal batch name that was entered during the initial journal entry. For interfaced deposits, the Journal Batch Name contains information representing the specific interface the transaction was received from. | |

| Journal Category | This field displays the Journal Category chosen when the Journal was created. | |

| Journal Status | This field displays if the transaction has been posted or is unposted. | |

| Approval Status | This field displays the Approval Status of the Journal Batch. |

Wrap Up

The Deposit Report provides summary and detailed information for deposits created within a specified date range. The details tab shows information on deposits by Journal batch, budget code, and agency. The report is in a Microsoft Excel format to allow users to take advantage of standard Microsoft Excel functionality. The Deposits Report is used frequently throughout the day by the Department of the State Treasurer (DST) to review deposits submitted for approval and check for errors. This report can be scheduled daily and can be sent to the user via email.

Additional Resources

- Instructor Led Training (ILT)