Purpose

The purpose of this Quick Reference Guide (QRG) is to explain how to navigate to and generate the Negative Budget Code Report in the North Carolina Financial System (NCFS).

Introduction and Overview

This QRG covers the navigation to the Negative Budget Code Report and how to generate the report output. The Negative Budget Code Report provides NCFS users negative cash balances by budget code (only negative amounts are included in the report). The purpose of the Negative Budget Code Report is to allow users to easily identify any budget code with a negative cash balance.

Navigating to the Negative Budget Code Report

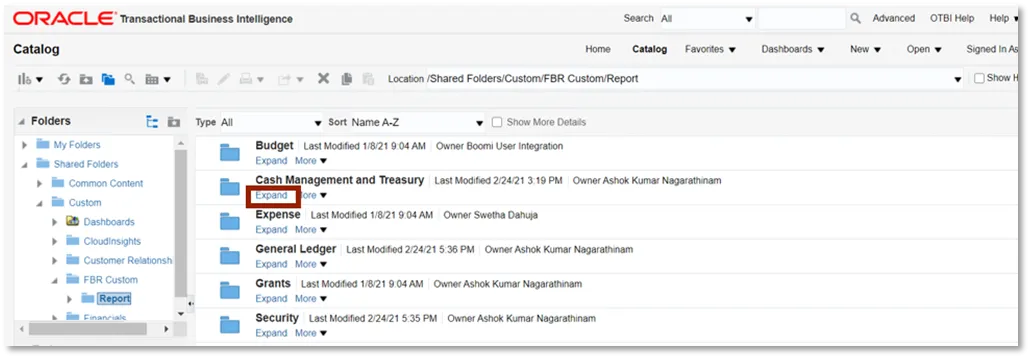

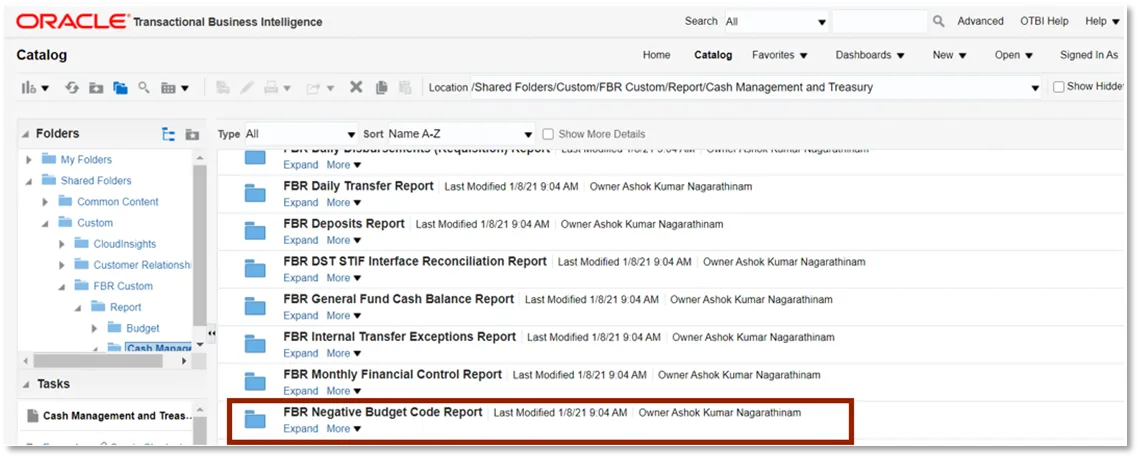

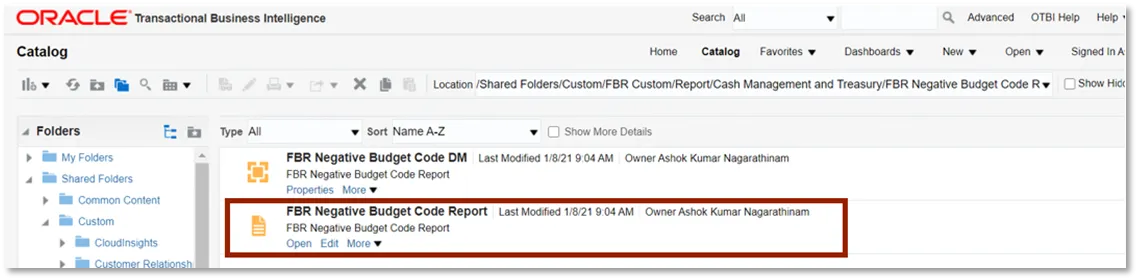

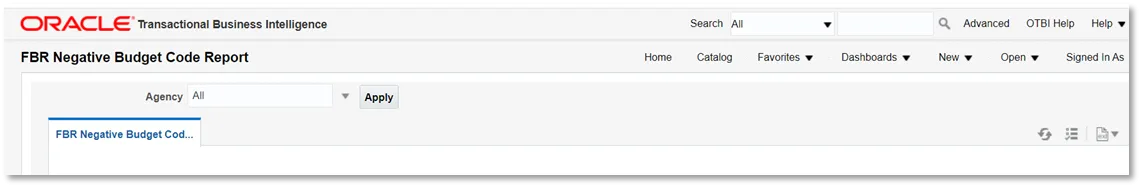

To navigate to the Negative Budget Code Report, please follow the steps below. There are 4 steps to complete this process.

Step 1. Click Expand in the Cash Management and Treasury section.

Step 2. Click Expand under the FBR Negative Budget Code Report.

Step 3. Click Open under the FBR Negative Budget Code Report.

Step 4. Select the desired Agency. Then click Apply.

User Tip

This report has no date parameters. It is intended to provide a daily “snapshot” of agency budget code negative balances. If historical information regarding negative balances is required, then agencies should capture and save the Excel report with a date/time stamp for documentation purposes.

Negative Budget Code Report Output

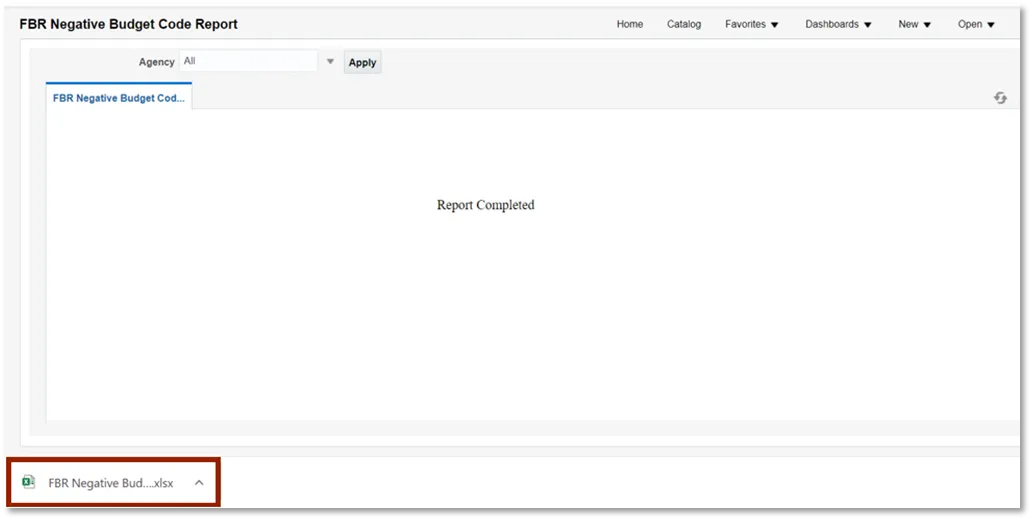

To navigate to the FBR Negative Budget Code Report output, please follow the steps below. There are 2 steps to complete this process.

User Tip

When running the reports in Firefox, a popup window opens asking if you want to Open or Save the file.

Step 1. In the bottom left-hand corner, click the Microsoft Excel Document.

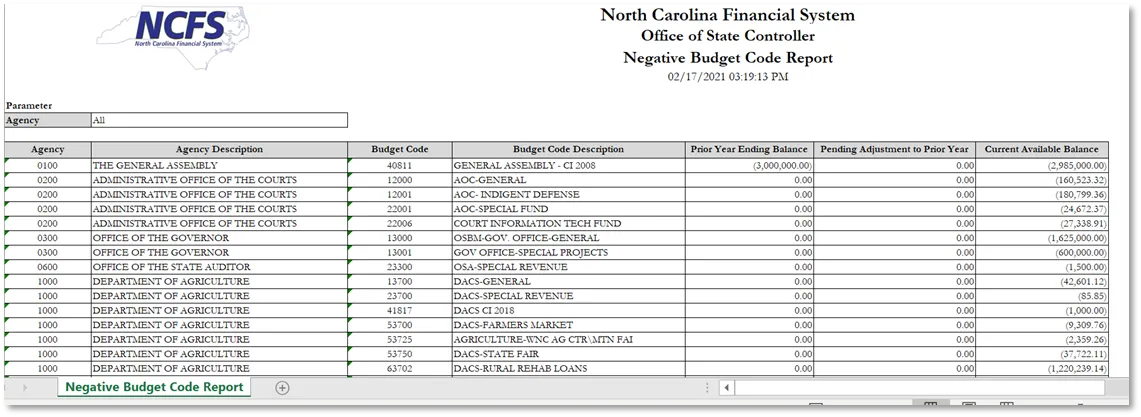

Step 2. Review the FBR Negative Budget Code Report.

| Report Field Name | Report Field Description |

|---|---|

| Agency | This field displays the agency code assigned to the organization. |

| Agency Description | This field displays the Agency Name. |

| Budget Code | This field displays the agency budget code for the transaction displayed. |

| Budget Code Description | This field displays the budget code title. |

| Prior Year Ending Balance | This field displays the cash balance for the budget code at the end of the prior fiscal year. |

| Pending Adjustment to Prior Year | This field displays pending reversion amounts for reverting budget codes in the new fiscal year until those reversions are posted. |

| Current Available Balance | This field displays the amount of cash available at the report run date. |

Wrap Up

The purpose of this report is to provide the State with a list of budget codes with negative cash balances. The Negative Budget Code Report provides a daily listing of all budget codes that have negative cash balances after all cash transactions have posted to the ledger. This report lists out Budget codes with negative balances only.

Additional Resources

Instructor Led Training (ILT)

• GL100c: Journal Entry