Purpose

The purpose of this job aid is to answer frequently asked questions (FAQs) about payroll.

The Training HELP documents referenced throughout this document are located on the OSC Training Website.

For more detailed information:

- Core users - Maintain Bank Details Information IT0009

I opened a new bank account. What should the effective date be?

Any change made to the bank details can be made for the current month up to the last day of corrections. However, if you want to make the changes effective as of your next pay date, then you must make the change effective on the first day of the next payroll period. If you are a monthly employee, this will be the first day of the next available month. If you are biweekly this will be the first day of the next available pay period.

Under Bank Details (IT0009) you have bank details type such as main bank, other bank, etc. What is the meaning of Main Bank Details Off-Cycle and Other Bank Details Off-Cycle?

Employees may choose to receive multiple direct deposits; the first deposit is paid as a flat dollar amount or percentage of net pay to IT0009/subtype Other Bank, used when an employee wants to split their payments of wages and salaries. The remaining portion of net pay is paid to IT0009/subtype Main Bank, the employee’s primary bank details payments of wages and salaries.

At this time Main Bank Details Off cycle and Other Bank Details Off-Cycle are not being used.

Creditable Service

Some employees work for county agencies and not State agencies; however, their time at the county agency would count toward longevity pay if they were ever a State employee. How will BEST calculate creditable state service for longevity pay when an employee works for a county/other agency that's not under the Integrated HR-Payroll System?

Once creditable service from non-Integrated HR-Payroll System entities is verified, the agency enters the additional service time on Infotype 0552. Typically, this is done at the time of hiring an employee into the Integrated HR-Payroll System.

Deductions

The priority of deductions is as follows:

- State Retirement

- Tax Deferred and pre-tax deductions (i.e. pretax 401K, 457, Flex plans, health insurance, parking)

- Taxes (FICA, Federal, State)

- Child Support

- Any other garnishment

- 401K and 457 loans

- Any other deductions - this includes any post tax deductions like the Credit Union, SEANC, and all agency specific deductions. Within this last group, the deductions are taken based on the number of the wage type. So, Credit Union wage type 2400 will be taken before combined campaign wage type 2405 but after post tax parking which is wage type 2103.

Exempt Status

I file with an exempt status, and my deductions were Single 0 for both state and federal. Why?

Form W-4 and/or NC-4 claiming exemption from withholding is valid for only one calendar year and expires on February 15 of the next calendar year. To continue to be exempt from withholding in the next year, an employee must submit a new Form W-4 and/or NC-4 claiming exempt status between December 1 and February 15. If the employee does not submit a new Form W-4 and/or NC-4, BEST is required to withhold tax as “single with no withholding allowances,” if there is no prior valid withholding record.

I have changed my withholding elections in ESS to Married and 4 allowances, but my pay stub still shows Single and 00. Why isn’t the system taking these changes?

It is possible that the IRS or NC Department of Revenue has issued a mandate that your withholding cannot exceed Single and 00. If your pay stub does not reflect your changes in ESS, contact your HR-Payroll office or BEST Shared Services to determine if there is a mandatory withholding order in place. Only the IRS or NC Department of Revenue can release their mandatory withholding orders, and you should contact them to negotiate a release.

I tried to change my tax withholding status to exempt in ESS, but it would not let me make the change. Why?

Exempt status can be keyed only by your HR-Payroll office or by submitting Form W-4 and/or NC-4 claiming exemption from withholding to BEST Shared Services. In fact, you can make changes to your withholding through ESS only when your elections are currently not exempt, or when you are trying to change to exempt status.

Garnishments

I received a garnishment letter in the mail. Why are my wages being garnished?

The garnishment notification letter from BEST Shared Services includes the originator’s name (e.g., IRS), the plaintiff’s name or character of the garnishment (e.g., 2009 taxes), the garnishment case number listed on the order, and the calculation of the deduction (e.g., $100.00 per pay period.)

You must contact the vendor for specific information about why your wages are being garnished or to dispute the garnishment amount. Garnishments are legal documents that BEST Shared Services must honor. BEST cannot stop the garnishment without a release order from the vendor.

I received two garnishment notification letters in the mail. Will both garnishments be deducted at the same time?

If a single vendor sends BEST Shared Services two orders of garnishment, the first order will be deducted and the second will remain in pending status until the first one is released. Once the first order is released, the second garnishment will be activated, and deductions will begin. However, if the two orders are from different vendors, then both orders will be processed simultaneously.

How can I find out if a release order has been received to stop my garnishment?

Contact BEST Shared Services and a garnishment specialist will assist you.

Does BEST accept faxed garnishment documents?

Yes, BEST Shared Services accepts faxed documents. Fax garnishment documents to (919) 875-3844. This is a separate, secured fax line for garnishment related correspondence.

If I pay off the garnishment liability directly to the vendor, how do I stop the garnishment?

Once a garnishment has been keyed, it can be stopped only when a release is sent to BEST Shared Services. A receipt, indicating that a payment has been made, is not adequate documentation to initiate a release. Contact the vendor and have them fax a release to the secured garnishment fax at (919) 875-3844.

Can someone explain how the garnishment deduction amount is calculated?

Except for IRS levies, the garnishment deduction amount is provided on the notification letter and always will be either a set amount per pay period or a percentage of gross or net disposable pay. An additional letter, explaining the methodology for calculating an IRS levy deduction is also sent to the employee, if appropriate.

IT0014 & IT0015

Can IT0014 & IT0015 be used for both recurring and one-time payments/deductions?

IT0014 is for recurring deductions/payments only. IT0015 is for one-time deductions/payments only.

What infotype(s) are used to display in recurring and non-recurring deductions.

IT0014 is for recurring deductions, and IT0015 is for non-recurring deductions.

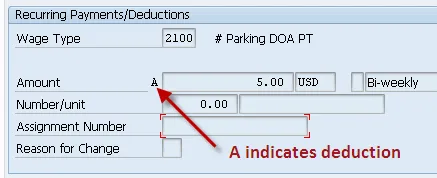

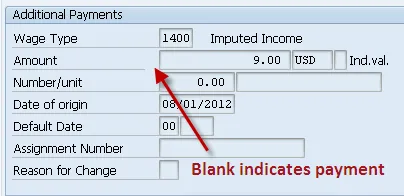

For IT0014 and IT0015, is there an indicator that shows if it is a payment or a deduction?

Longevity

For more detailed information:

- Core users

- Longevity Job Aid (reinstatement of employee within one year with longevity)

- Length of Service

When will I get my longevity?

Longevity is paid to employees each year once they have reached the 10-year length (Month 120) of service plateau. Only active employees are eligible for this type of pay.

Is there a report showing the longevity of an employee and when it was issued during a 12-month period?

Yes. Wage type reporter and variants ZPROD-BW LONGV or ZPROD-MO LGV for monthly population or biweekly population.

BI report B006: Estimated Longevity Eligibility/Length of Service

Off-Cycle Processing

What is the timeframe for replacing a check that has been lost, stolen or destroyed?

Replacement checks are generated and mailed within five business days after a completed Affidavit and Indemnity Bond form is received at BEST. Please note that affidavits must be signed by the employee and notarized.

What day of the month will the Off-Cycle run?

Off- cycle checks are primarily processed for employees who did not receive their regular base pay. Off-cycle processing is at the discretion of the State Controller. Generally, off-cycle payments are run on Tuesday night with a Wednesday payment date. However, off-cycles cannot be run during the payroll initialization/correction/finalization period for a biweekly or monthly payroll cycle.

BEST Shared Services makes that determination.

Overpayments

For more detailed information:

- Core users

How is a salary overpayment recovered through the payroll system? Does the system take a percentage or flat amount?

The payroll system automatically keeps all an employee’s future earnings and reimbursements until the full amount of any overpayment is recovered. The system does not take short-term disability payments to recover an overpayment unless the employee requests this in writing.

I have a financial hardship and cannot afford for all my wages to be taken immediately to repay my salary overpayment. Can my payment be broken down over several months to repay the overpayment?

Please contact your agency HR-Payroll office to negotiate a repayment plan.

If an employee is overpaid and has separated from their agency and has paid off the overpayment and gets re-hired at another agency, how will the HR-Payroll system know the overpayment has been paid?

Once a former employee has repaid an overpayment in full; the agency sends the full repayment amount to BEST. BEST processes the repayment through the payroll system to remove the overpayment balance. Should a former employee be rehired before the overpayment is paid in full, the HR-Payroll system will deduct the overpayment from the employee’s first paycheck automatically. A former employee with an overpayment balance is encouraged to notify his/her original agency that he/she is accepting a new job at another agency.

Pay Statements

For more detailed information

- Core users

Can you print my pay statement?

ESS users can display and print their pay statement from their My Pay tab. Non-ESS users should contact their HR-Payroll office.

If a person has direct deposit and suffers identify theft, can that person receive a paper check until it is straightened out

Exceptions to the Direct Deposit policy are made at the discretion of the State Controller. The impacted employee should complete a Direct Deposit Exemption Request form available through the OSC website. If an exception is granted the pay checks are mailed from OSC on payday to the Mailing Address on file for the individual. If this address type is blank, the Permanent Address is used instead.

Core users - Address Field Helps and Hints

Payroll Deductions

My paycheck has a deduction that should not have occurred. How can I get a refund?

Once deductions are sent to the vendor, employees must get in contact with the vendor to receive a refund. After the funds are sent to the vendor, it is the responsibility of the employee to seek recompense.

I want to cancel my payroll deduction.

If the deduction is agency specific, then this will need to be handled by the agency. The agency payroll admin can and will assist with this. If deductions have already been taken out, then BEST will not set up a refund. The employee will need to contact the company themselves if they seek recompense.

If the deduction is part of an inbound file (Prudential, SECU, SEANC, College Foundation, Parking, Colonial, Imputed Income) the employee must contact the company. BEST will not make any changes without authorization from the company. This information is sent through a batch feed and automatically generated in the system. Any changes will be sent to BEST through the company.

Payroll Deductions During a Leave of Absence

What is the process for an employee to pre-pay their insurances (voluntary and statutory deductions) when on a leave of absence?

If the employee is on a paid leave of absence, all payroll deductions process normally.

If the employee is on an unpaid leave of absence, the only deduction the employee can pre-pay is for the State Health Plan. The employee cannot pre-pay any voluntary deductions such as Credit Union, 401-K, 457, NC Flex insurance plans, or agency-specific insurance plans. The employee must work out other payment arrangements directly with the vendor for these deductions. It is a best practice for the agency HR-Payroll office to end the voluntary deductions while an employee is on a long unpaid leave of absence to prevent a large catch-up deduction taken for arrears or deductions not taken, in the event the employee returns to pay status.

It is also the employee’s responsibility to contact any garnishment vendors and make other payment arrangements in order to avoid any potential legal consequences for non-payment.

The agency will provide an employee on an unpaid leave of absence with a copy of the LOA Continuation Letter for health insurance. The employee must return the form to BEST indicating which health insurance plan, if any, is to be continued. The employee is responsible for mailing in the appropriate premium to continue the State Health Plan insurance during his/her LOA period. The payment must be received by BEST by the 15th of each month for the following month’s coverage.