Purpose

The purpose of this job aid is to explain how to calculate base pay for split months.

New Employee with a Start Date After the First Day of the Month

There are 6 steps to complete this process.

Step 1. Use PA20 to display Planned working time (IT0007) for the employee.

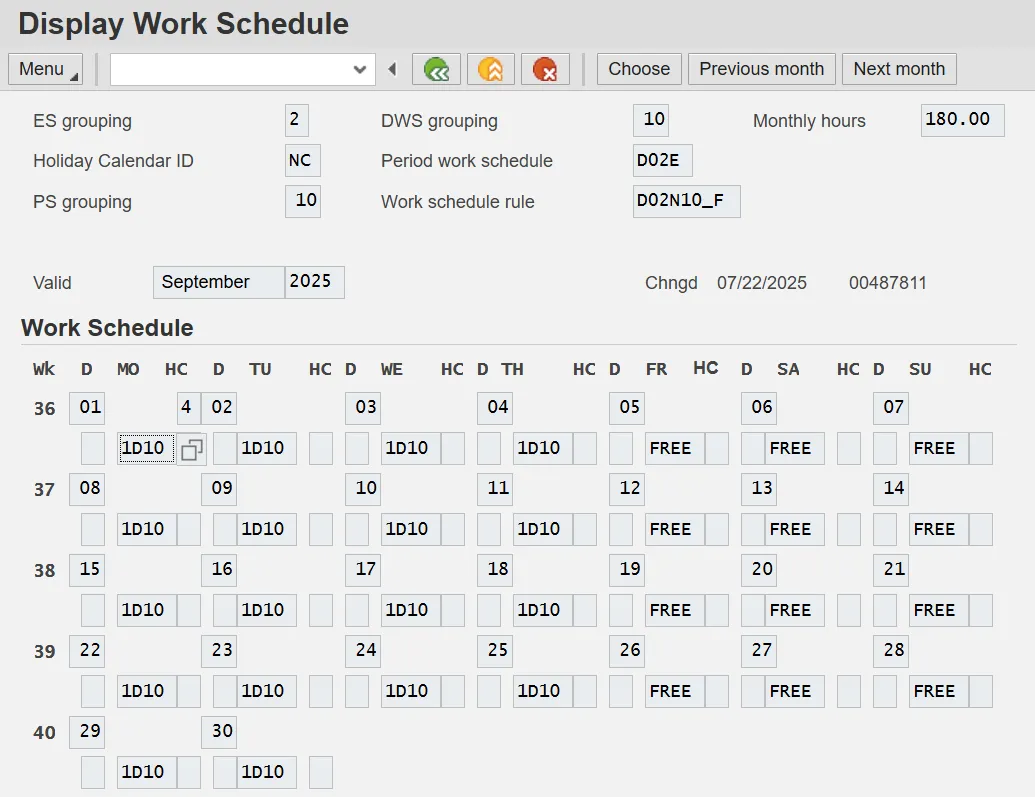

Step 2. Click the Work schedule button to display the calendar. Use the Previous Month or Next Month buttons to display the correct month.

Step 3. Count the days the employee worked.

Step 4. Count possible workdays in the month.

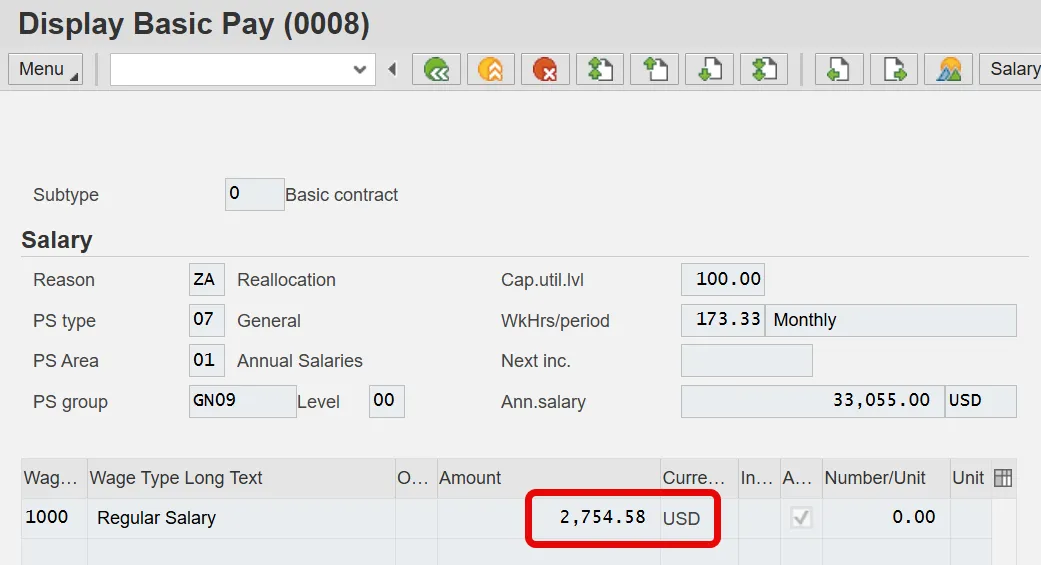

Step 5. Use PA20 to display Basic Pay (IT0008) and look at monthly base pay.

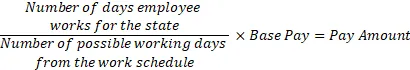

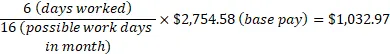

Step 6. Use this equation to figure base pay for the month:

Example 1

There are 4 steps to complete this process.

Thomas McGregor starts work on September 19.

Step 1. Use PA20 to view Planned Working Time (IT0007).

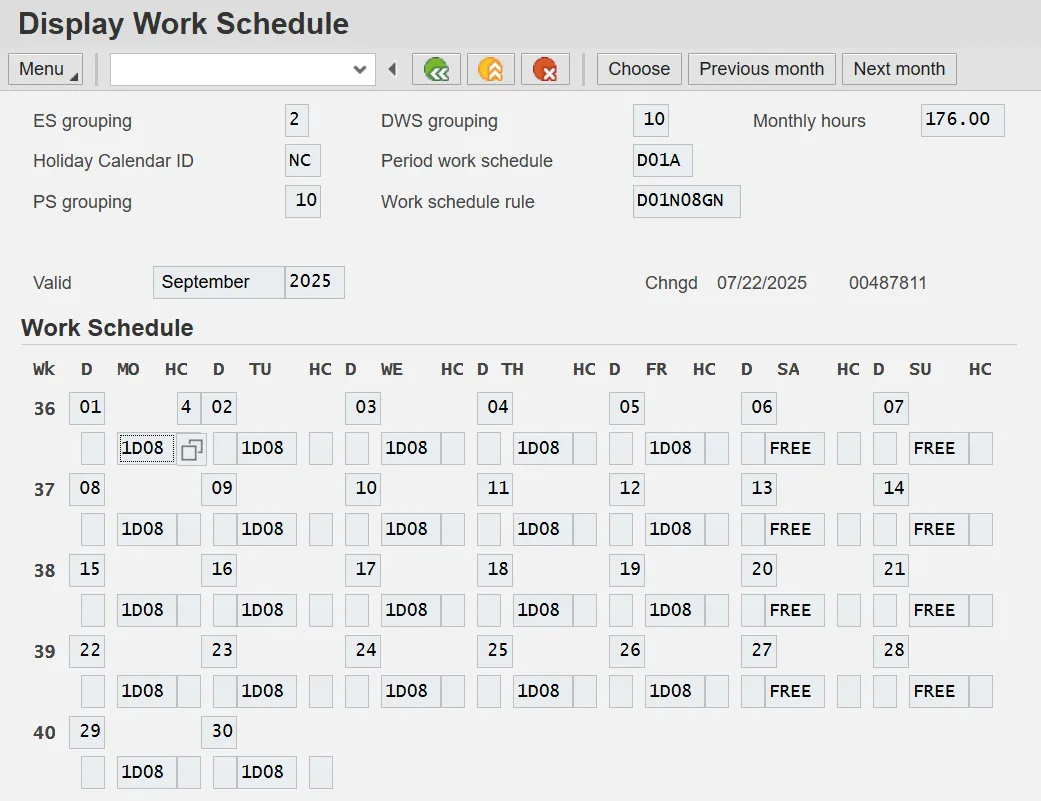

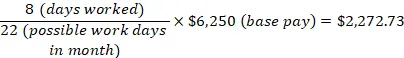

Step 2. Click the Work schedule button to look at Thomas’ work schedule. Counting 9/19, he worked 8 days of a possible 22 days.

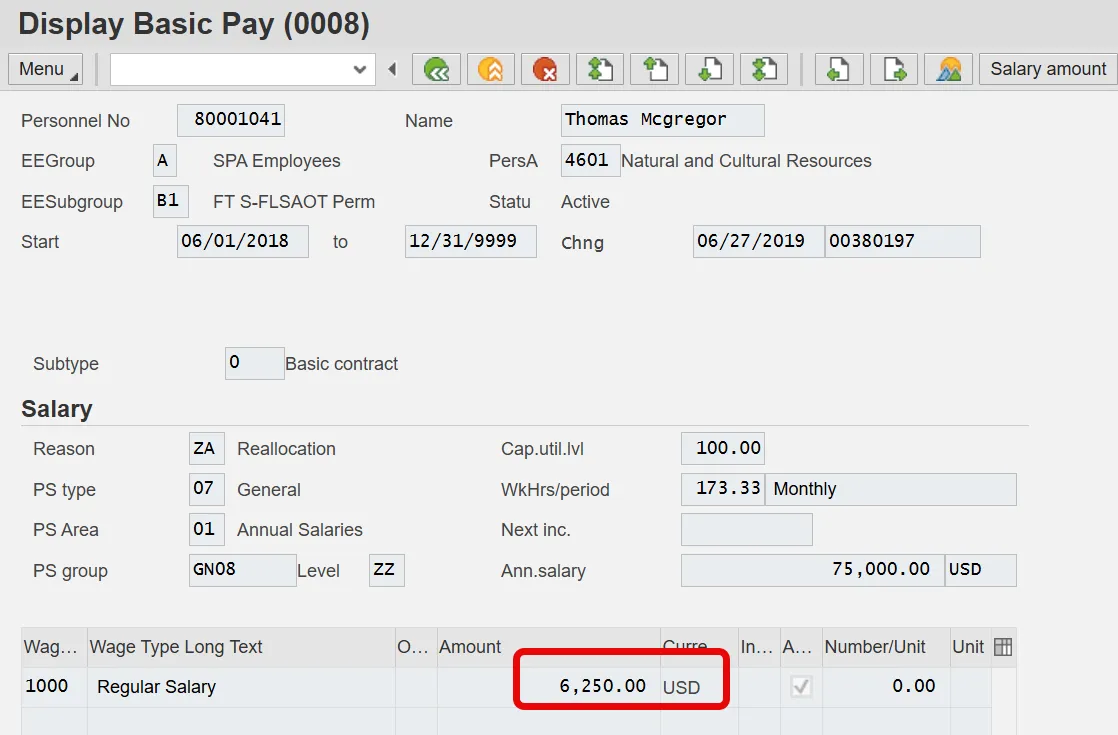

Step 3. Use PA20 and Basic Pay (IT0008) to find his monthly base pay, which is $6,250.

Step 4. Complete the calculation for September Pay.

Example 2

There are 5 steps to complete this process.

Rita Henry starts work on September 19.

Step 1. Use PA20 to view Planned Working Time (IT0007).

Step 2. Click the Work schedule button to look at her work schedule.

Step 3. Counting 9/19, she worked 6 days out of a possible 16.

Step 4. Use PA20 and Basic Pay (IT0008) to find her monthly base pay, which is $2,754.58.

Step 5. Complete the calculation for September Pay.

Current Employee with Mid-Month Salary Change

Figure Salary for First Part of the Month.

There are 6 steps to complete this process.

Step 1. Use PA20 to display Planned working time (IT0007) for the employee.

Step 2. Click the Work schedule button to display the calendar. Use the Previous Month or Next Month buttons to display the correct month.

Step 3. Count the days the employee worked at salary 1.

Step 4. Count possible workdays in the month.

Step 5. Use PA20 to display Basic pay (IT0008) to look at monthly base pay for salary 1.

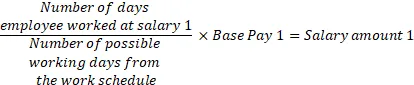

Step 6. Use this equation to figure base pay for salary 1.

Figure Salary for Second Part of the Month.

There are 7 steps to complete this process.

Step 1. Use PA20 to display Planned working time (IT0007) for the employee.

Step 2. Click the Work schedule button to display the calendar. Use the Previous Month or Next Month buttons to display the correct month.

Step 3. Count the days the employee worked at salary 2.

Step 4. Count possible workdays in the month.

Step 5. Use PA20 to display Basic pay (IT0008) to look at monthly base pay for salary 2.

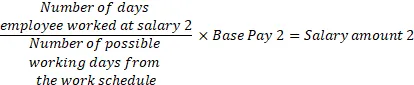

Step 6. Use this equation to figure base pay for salary 2.

Step 7. Use this equation to figure the total for the month.

Example 1

Thomas McGregor gets a salary increase mid-month and remains on the same work schedule 1.

Thomas McGregor works from October 1 to October 12 at a rate of $6,250 per month. Effective October 13, he gets a salary increase to $6,680 per month.

Figure Salary for First Part of the Month

There are 5 steps to complete this process.

Step 1. Use PA20 to display Planned working time (IT0007) for the employee.

Step 2. Click the Work schedule button to display the calendar. Use the Previous Month or Next Month buttons to display the correct month.

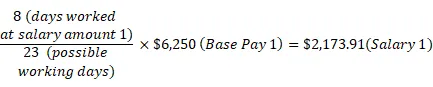

Step 3. Count the days he worked at $6,250 per month.

Step 4. Count possible workdays in the month.

Step 5. Use this equation to figure base pay for salary 1.

Figure salary for Second Part of the Month.

There are 5 steps to complete this process.

Step 1. Use PA20 to display Planned working time (IT0007) for the employee.

Step 2. Click the Work schedule button to display the calendar. Use the Previous Month or Next Month buttons to display the correct month.

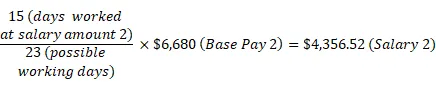

Step 3. Count the days the employee worked at $6,680 per month. Since it is the same schedule, possible workdays should remain the same.

Step 4. Use this equation to figure base pay for salary 2.

Step 5. Use this equation to figure the total for the month.

Example 2

Wanda Hill changed positions mid-month, had a schedule change, and a mid-month salary increase.

Employee Wanda Hill works from September 1 to September 19 at a rate of $6,250. Starting September 23, she starts a new position with a new schedule and a salary increase to a rate of $6,680.

Figure Salary for First Part of the Month

There are 5 steps to complete this process.

Step 1. Use PA20 to display Planned working time (IT0007) for the employee.

Step 2. Click the Work schedule button to display the calendar. Use the Previous Month or Next Month buttons to display the correct month.

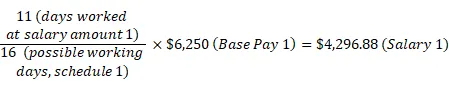

Step 3. Count the days she worked at $6,250 per month.

Step 4. Count possible workdays in the month for the first schedule. From 9/1 to 9/19, she worked 11 days out of a possible 16.

Step 5. Use this equation to figure base pay for salary 1.

Figure Salary for Second Part of the Month.

There are 6 steps to complete this process.

Step 1. Use PA20 to display Planned working time (IT0007) for the employee.

Step 2. Click the Work schedule button to display the calendar. Use the Previous Month or Next Month buttons to display the correct month.

Step 3. Count the days she worked at $6,680 per month.

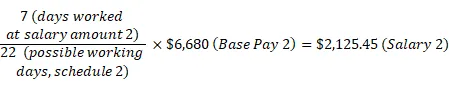

Step 4. Count possible workdays in the month for the second schedule. From 9/20 to 9/30, she worked 7 days out of a possible 22.

Step 5. Use this equation to figure base pay for salary 2.

Step 6. Use this equation to figure the total for the month.