Purpose

The purpose of this Business Process Procedure is to explain how to view a recurring deduction or payment that is either deducted from an employee’s pay or paid to the employee in the Integrated HR-Payroll System.

Trigger

Use the procedure to view a recurring deduction or payment that is either deducted from an employee's pay or paid to an employee.

Business Process Procedure Overview

Use this procedure to display recurring payments or deductions. Examples of this transaction would include:

- Cell Phone Supplement

- Parking

- Membership Dues

Access Transaction

Via Menu Path: Your menu path may contain this custom transaction code depending on your security roles.

Via Transaction Code: PA20

Procedure

There are 11 steps to complete this process.

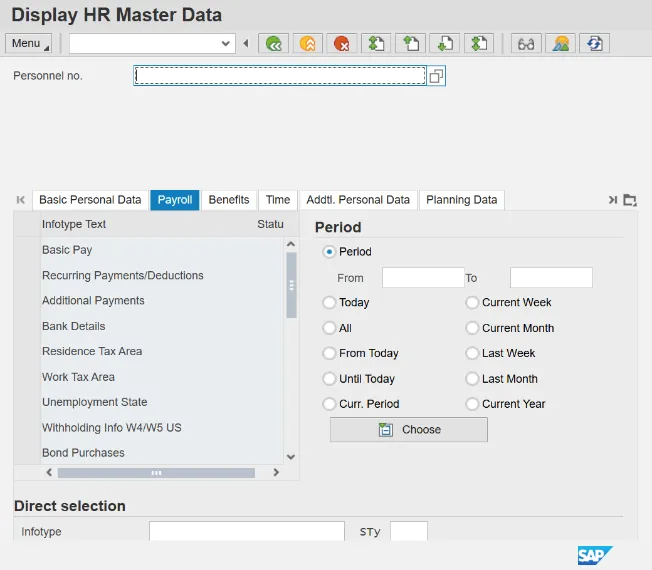

Step 1. On the SAP Easy Access screen, update the following field.

| Field Name | Description | Values |

|---|---|---|

| Command | White alphanumeric box in upper left corner used to input transaction codes. |

Enter value in Command. Example: PA20 |

Step 2. Click Enter.

Step 3. Update the following fields.

| Field Name | Description | Values |

|---|---|---|

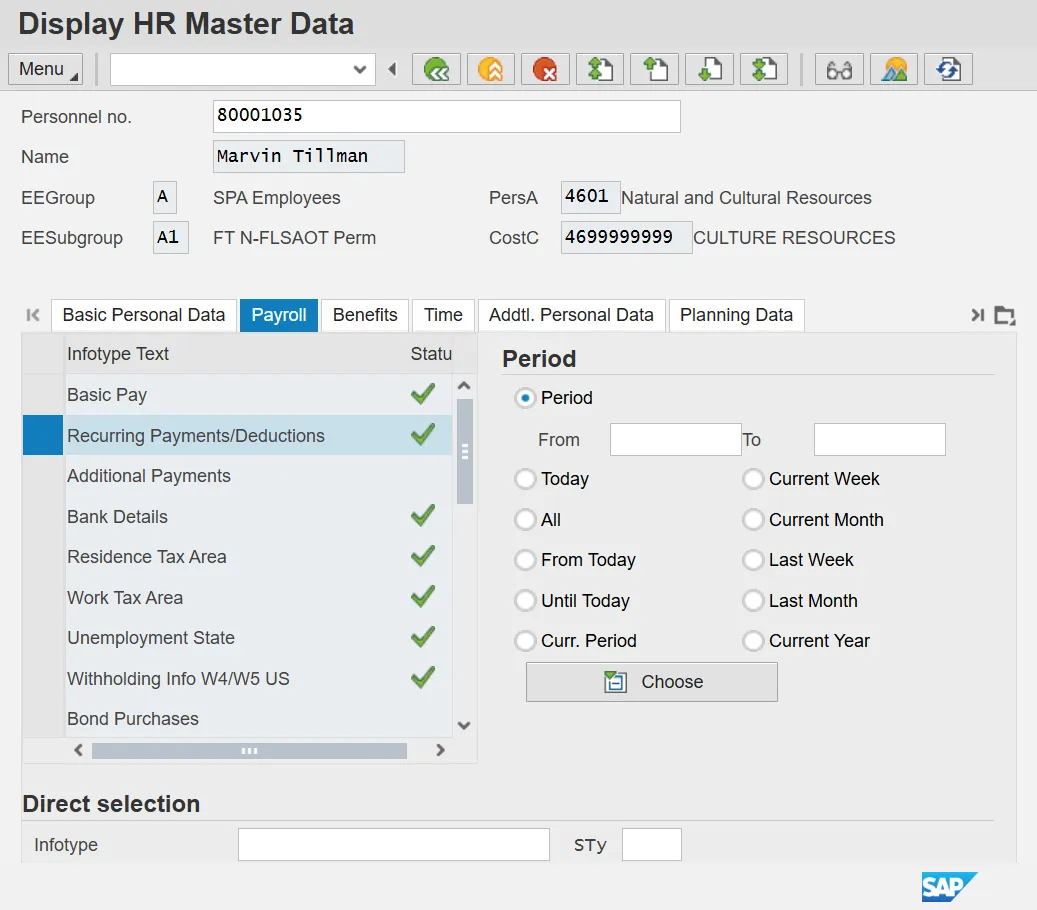

| Personnel No. | Unique employee identifier. |

Enter value in Personnel No. Example: 80001035 |

Step 4. Click Enter.

Step 5. Click the Payroll tab.

Select the appropriate Infotype to display. Infotype records can be accessed through the various Tabs or through the Direct Selection section of the screen. Infotypes listed within the Tabs with a corresponding green checkmark indicate that the infotype record is populated with data. Infotypes without a green checkmark may not be populated at this time.

Step 6. Click to the left of the Recurring Payments/Deductions infotype.

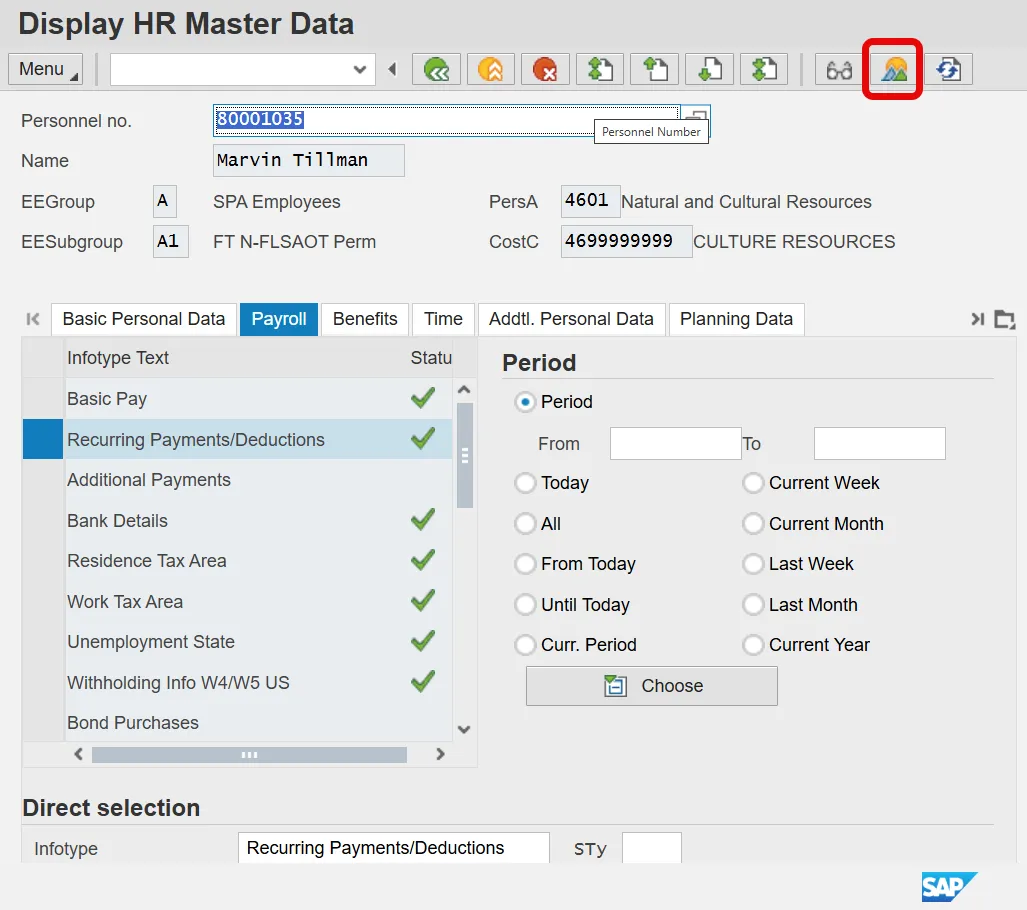

Step 7. Click the Overview button.

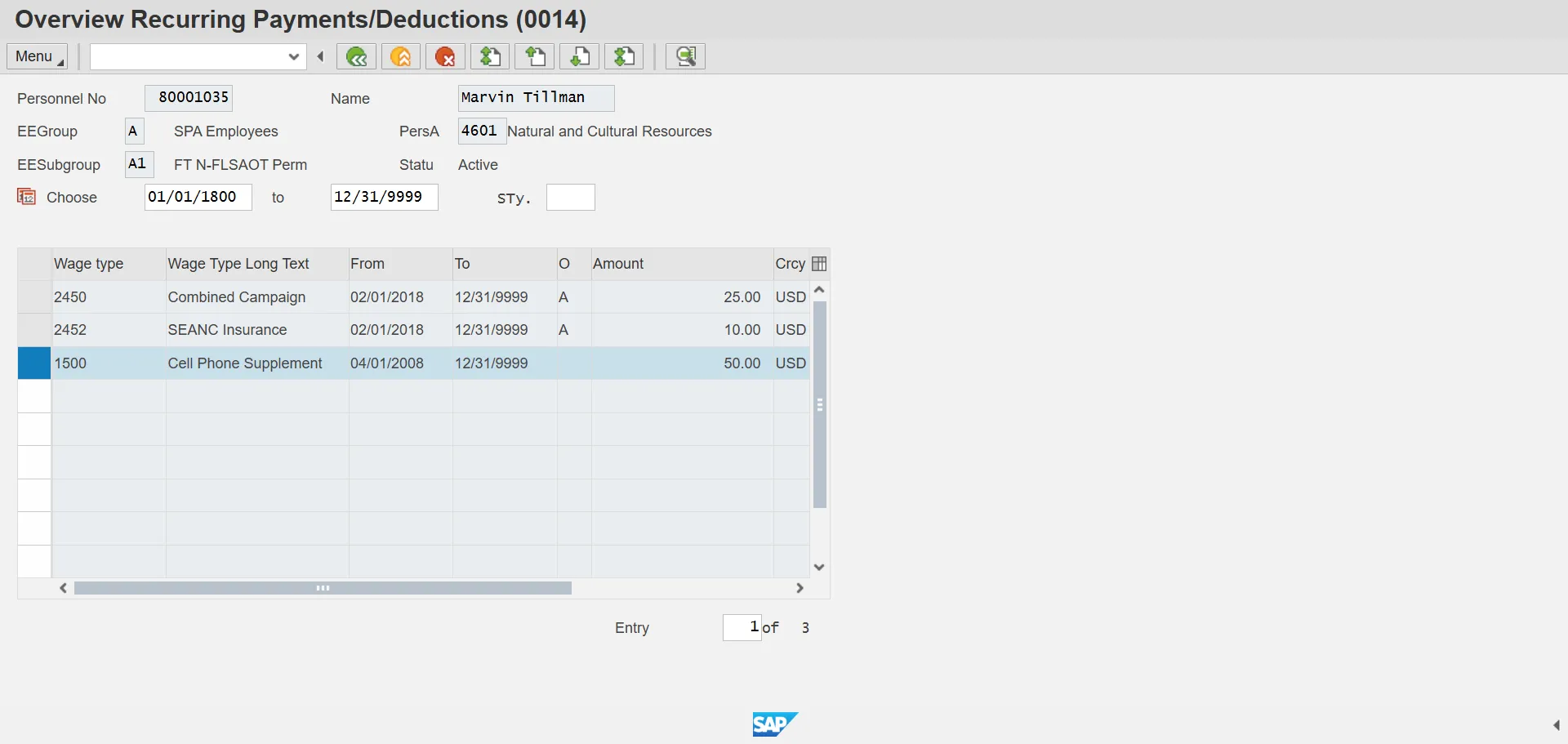

Step 8. Click to the left of the desired Payment/Deduction record.

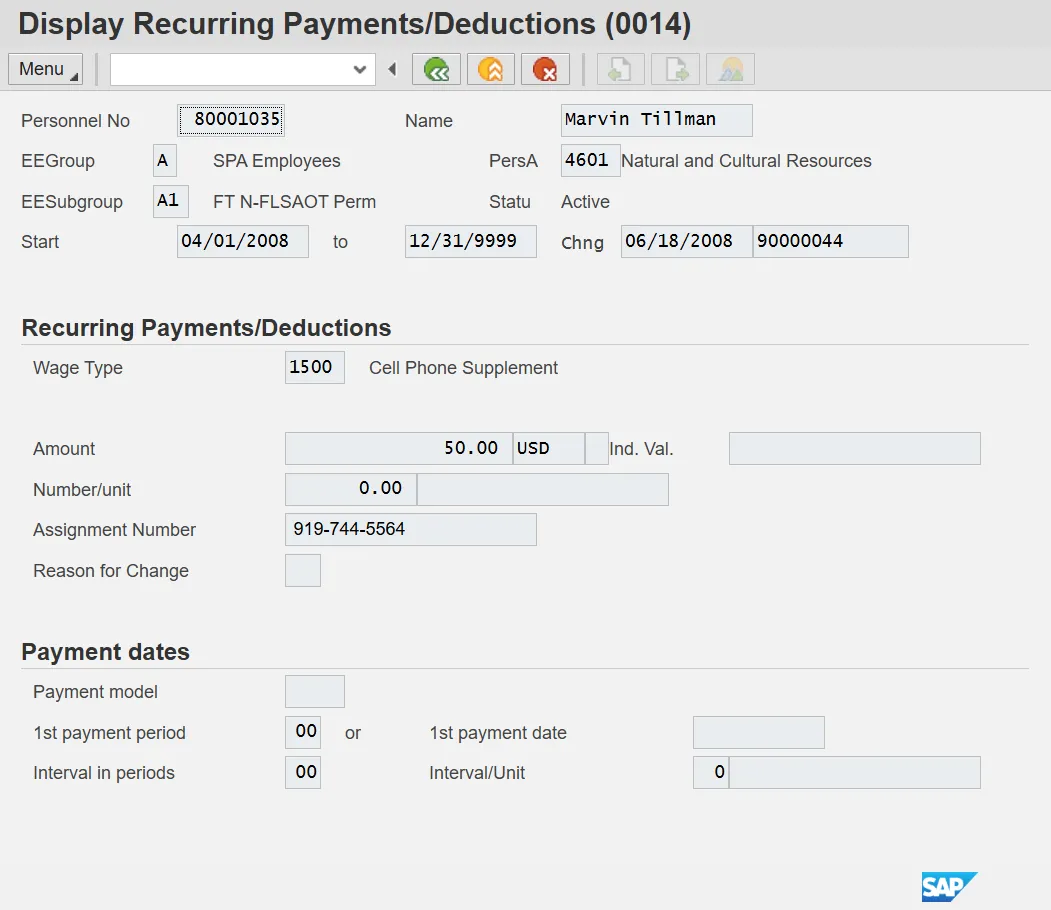

Review the Recurring Payments/Deductions infotype data as appropriate. There may be multiple records for IT0014 available by clicking on the next record. If there are multiple records listed on the screen, additional data is available on other tabs.

Step 9. Click the Choose button.

The table below provides a description of fields in IT0014.

| Field | Description |

|---|---|

| Wage Type | Type of deduction/payment for the employee per pay period. |

| Amount |

Amount of deduction or payment Note: Both payments and deductions are entered as positive amounts. An “A” to the left of the amount field indicates that a deduction wage type has been selected. |

| Reason for Change | This is the reason for change in the data in the infotype. |

| Payment model | The payment model defines a time pattern in which deductions are withdrawn and payments made. |

| 1st Payment period | This is the first period in which the recurring payment or deduction is to be made. |

| 1st Payment date | This date defines the payroll period in which the recurring payment or deduction is to be made the first time. |

| Interval in periods | This is the number of periods that should lie between two consecutive payments. |

| Interval/Unit | This field together with the Unit field defines the interval between recurring payments and deductions. |

Step 10. Click the Green Arrow Back button until you are returned to the SAP Easy Access screen.

Step 11. The system task is complete.