View My Tax Withholding Tutorial Video

Purpose

The purpose of this Business Process Procedure is to explain how to access and modify Federal (W-4) and NCDOR (NC-4) Employee’s Withholding Certificates within the Fiori My Tax Withholding application. Fiori applications are accessible via desktop, laptop, and mobile devices.

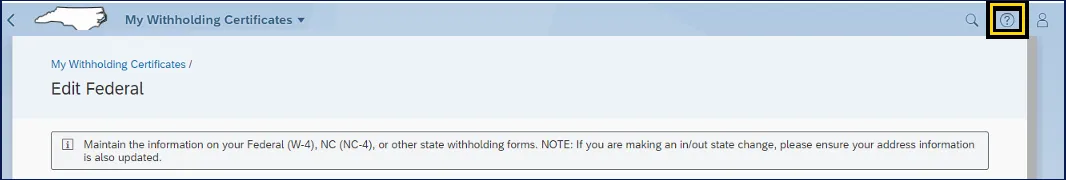

The following information can be used to manage the information on your Federal (W-4) or NC (NC-4), or other state withholding forms. Ensure the address information is accurate and up to date if you are making an in/out of state change. It is also important to notify your HR Representative of any in/out of state changes.

W-4 Federal

Employees should read the instructions within the Federal W-4 form. The Federal W-4 Employees Withholding Certificate form is available on the IRS website. If an employee has additional questions about the W4 form, please refer to the IRS Frequently Asked Questions. The Federal W-4 Employees Withholding Certificate form & the Federal Form W-4 FAQ’s can also be accessed within the Fiori My Reports & Resources application on the Personal Data card.

There are 3 steps to complete this process.

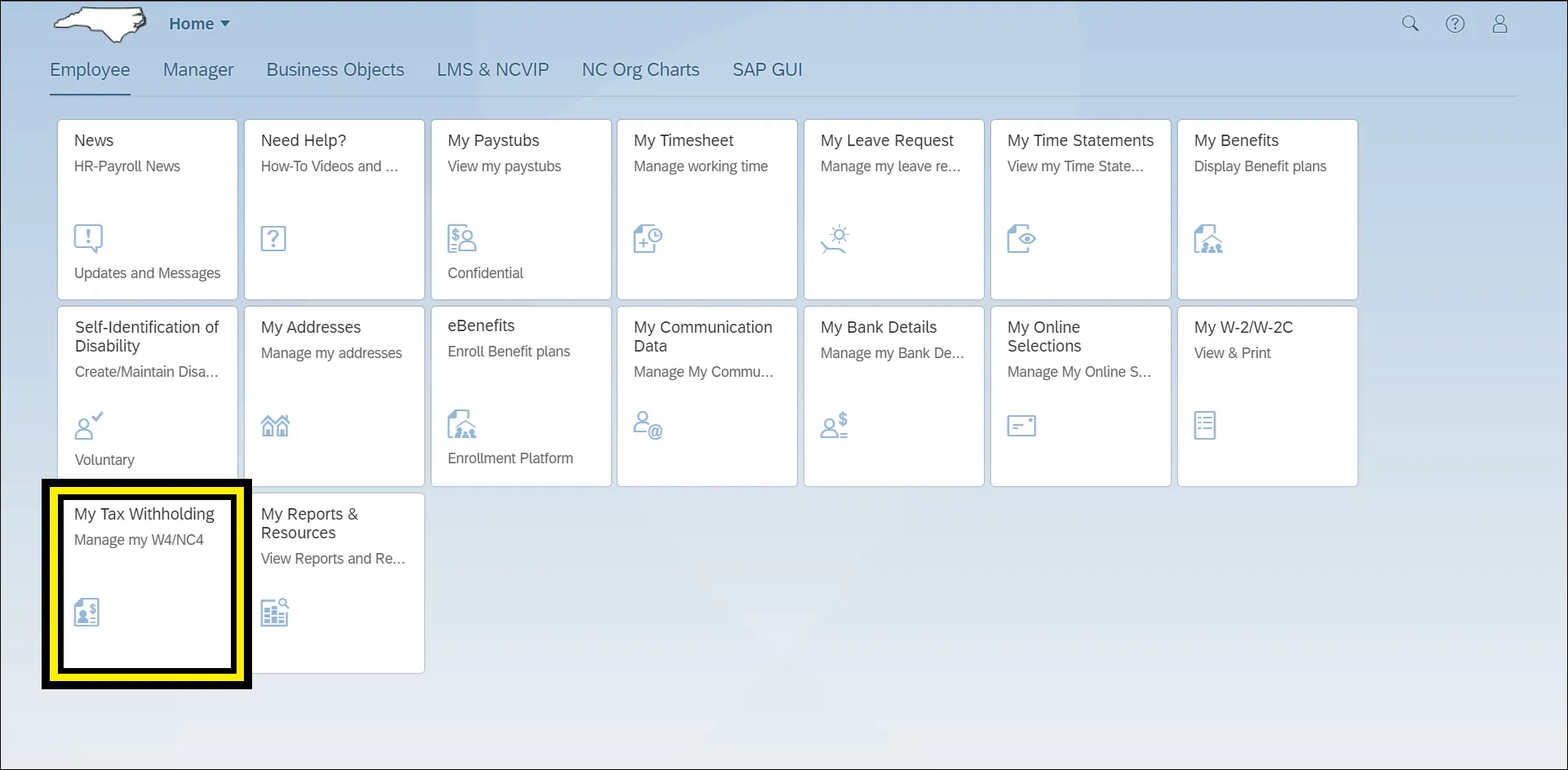

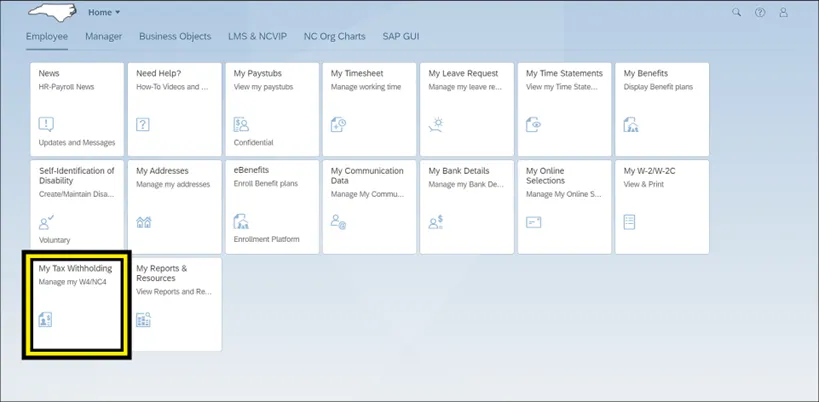

Step 1. Navigate to the Employee tab within the Fiori Application.

Step 2. Click to open the My Tax Withholding application.

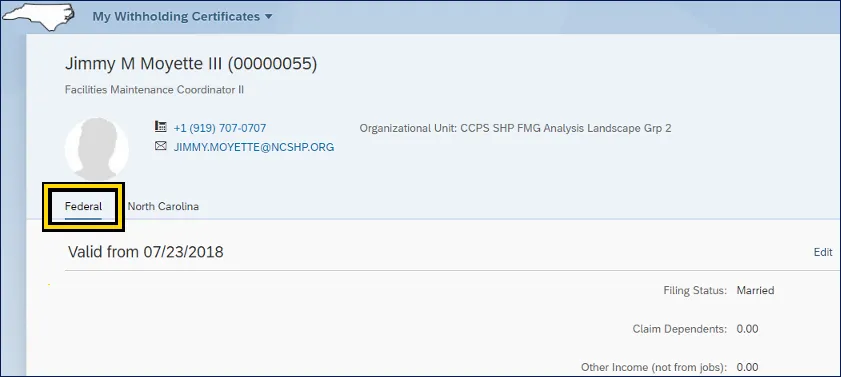

Step 3. The application defaults to display the employees current W-4 Federal Tax Withholding selections for filing status, dependents, other income, deductions, and extra withholdings information.

Completing the Form

The following steps explain how to maintain the information on the Federal (W-4) form. There are 3 steps to complete this process.

Note: The following process can also be used for the NC (NC-4) or other state withholding forms.

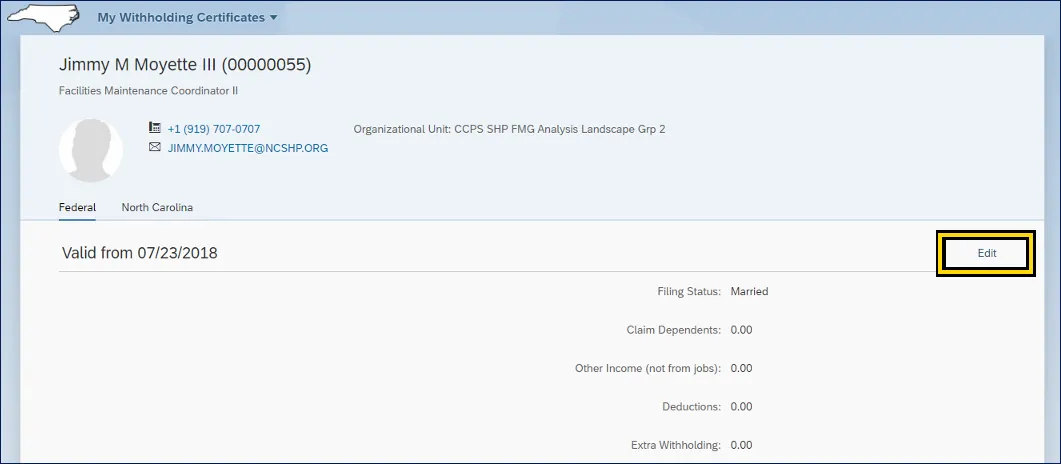

Step 1. Click Edit to make changes.

Note: Address information should be updated if making an in/out of state change. Notify your HR Representative if you are making an in/out of state change.

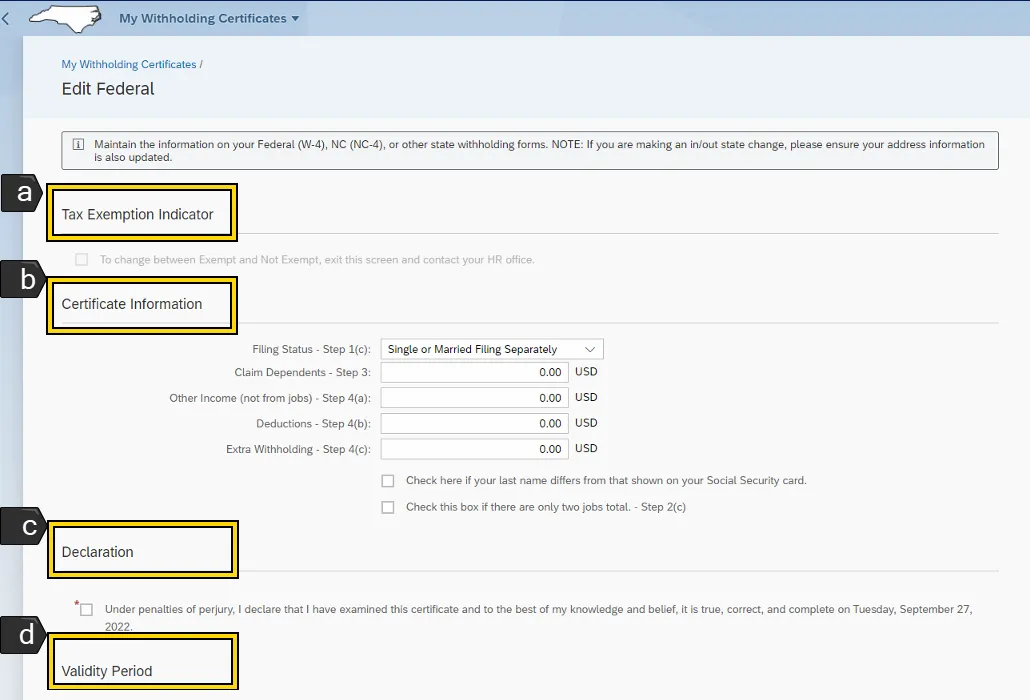

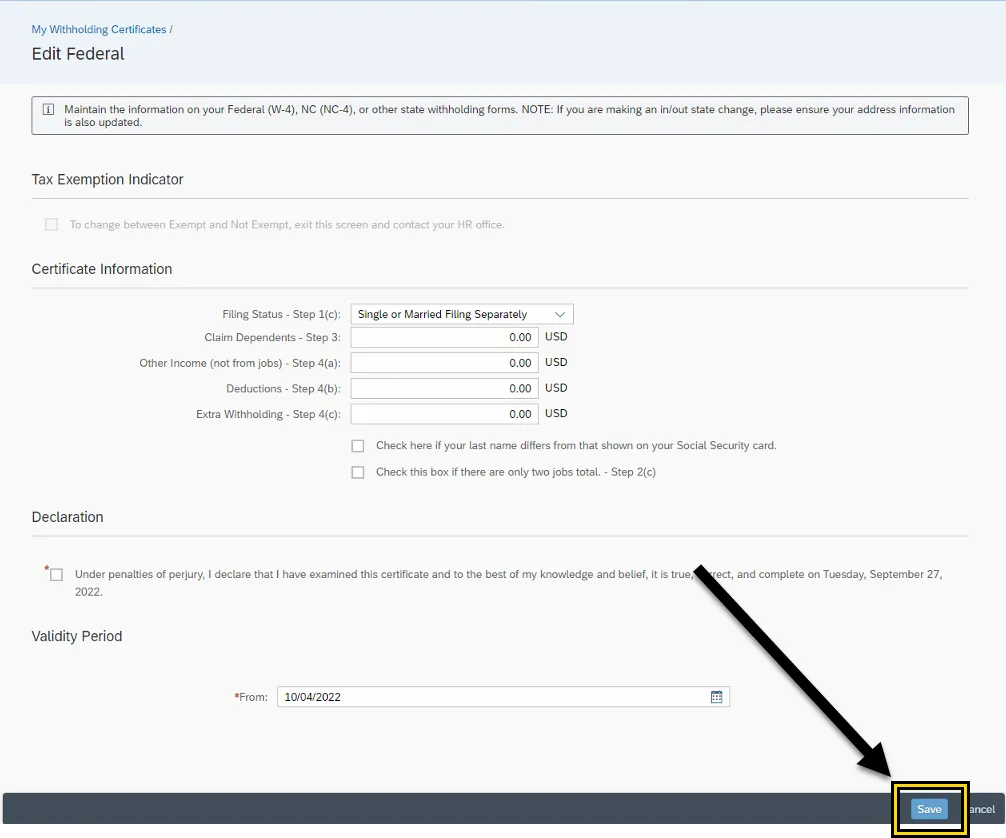

Step 2. There are four areas within the Federal W-4: Tax Exemption Indicator, Certificate Information, Declaration, Validity Period.

a. Tax Exemption Indicator

i. This area is grayed out and cannot be modified by the employee.

ii. The grayed-out information states “To change between Exempt and Not Exempt, exit this screen and contact your HR office.”

Note: Employees must contact their HR office to change between Exempt and Non-Exempt.

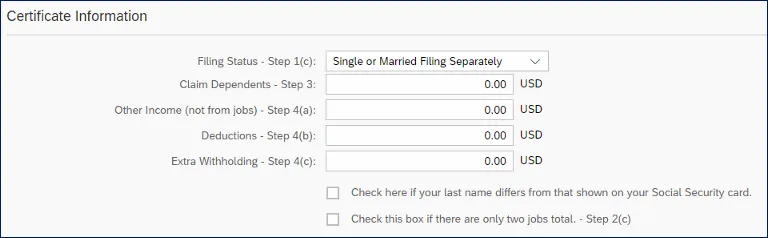

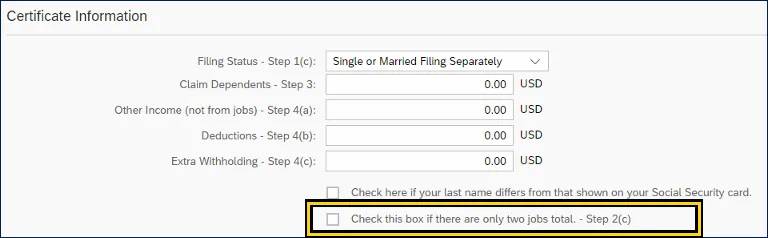

b. Certificate Information

i. Certificate Information area can be edited by the employee. Employees can use the Federal W-4 form and additional IRS worksheets to calculate the information for each field.

Note: These forms can be found/accessed on the Personal Data card within the My Reports & Resources application/title.

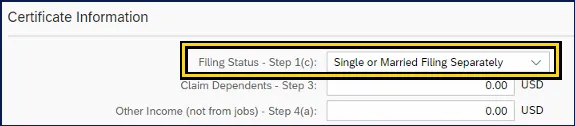

ii. Select the dropdown box for Filing Status -Step 1(c) to select the appropriate filing status from the available options: Single or Married Filing Separately; Married Filing Jointly/ Qualifying Widow; Head of Household.

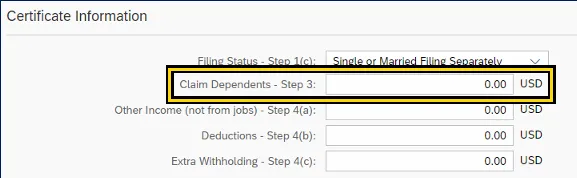

iii. Click the field Claim Dependents – Step 3 and enter the credits for dependents. The amount entered must be $500 or more.

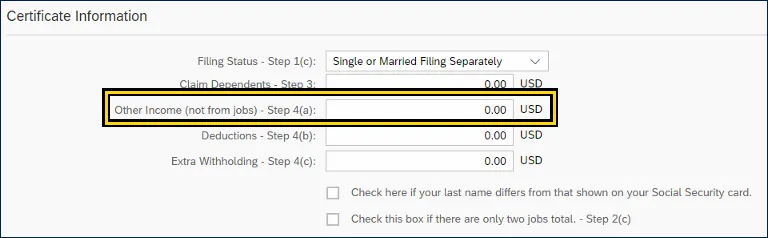

iv. Click the field Other Income (not from jobs) - Step 4(a) to enter the amount of other income not from jobs.

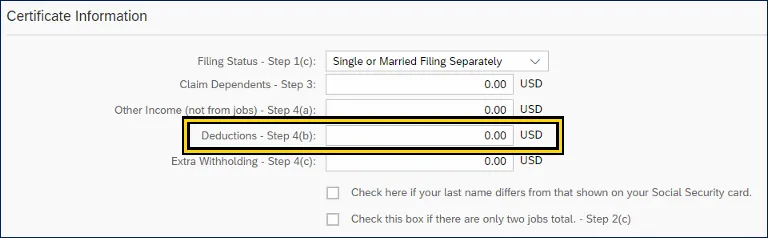

v. Click the field Deductions - Step 4(b) to enter deductions, other than the standard deduction, calculated from the Federal W-4 form.

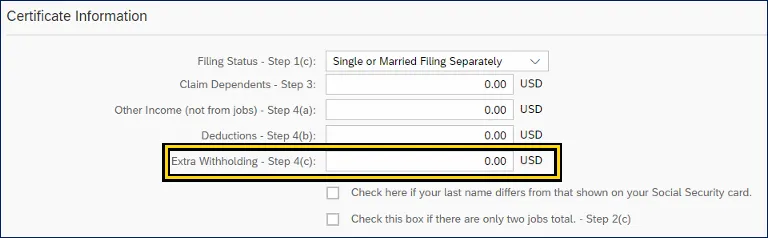

vi. Click the field Extra Withholding – Step 4(c) to enter any additional tax you want withheld each pay period.

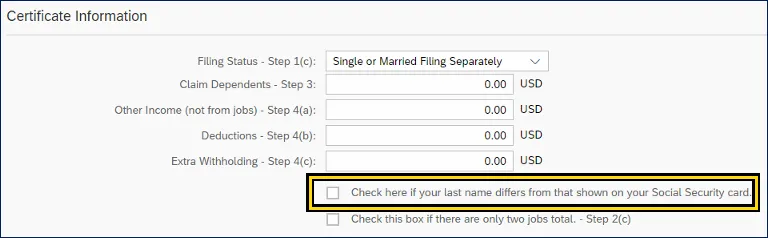

vii. If your last name appears differently on your security card than the name displayed in the top header of the Tax Withholding, click the check box below the Extra Withholding selection.

viii. The last checkbox (Check this box if there are only two jobs total – Step 2(c)) can be checked if there are only a total of two jobs.

Note: All Certificate Information fields are referenced with the same field titles and reference numbers to the Federal W-4 Employees Withholding Certificate.

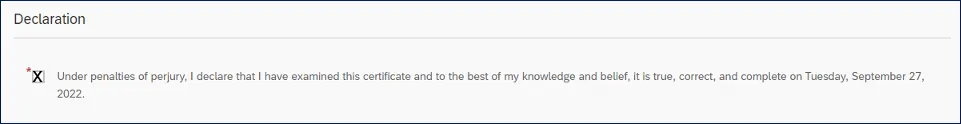

c. Declaration

i. The employee must check the checkbox to declare the information placed in the Certificate information is true and correct.

Note: The Declaration field is required when there has been a change in the Certificate Information. The checkbox must be checked for the changes to be saved.

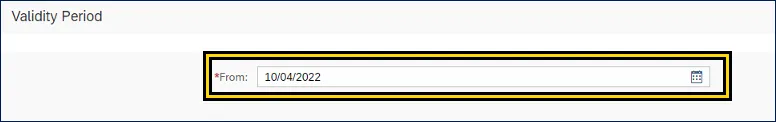

d. Validity Period

i. The default date displayed is future dated by a standard defined date from today’s date.

ii. Select any future date after the defaulted displayed date for the changes to take effect. The future date must be at least seven days from today’s date.

Note: Do not enter a date that occurs before the default date. If a date is selected that occurs before the default date, an error message will generate.

Step 3. Click Save, once all modifications have been entered, the declaration checked, and the validity period selected.

NC-4 North Carolina

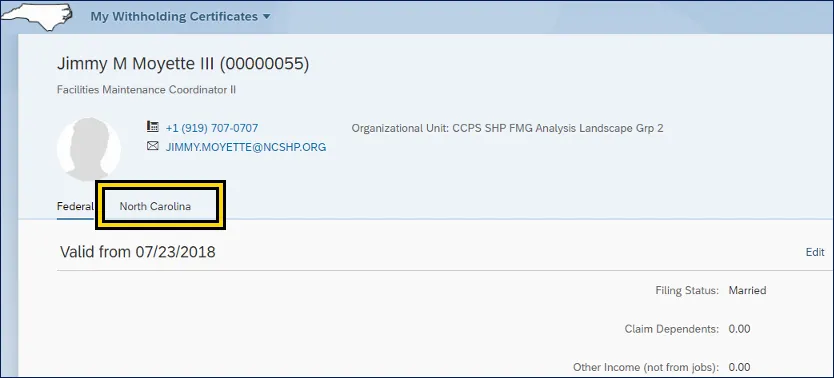

The North Carolina tab delivers Tax Withholding information for the current NCDOR Employees Withholding selections for Filing Status, Total Number of Allowance, and Additional Withholdings.

There are 3 steps to complete this process.

Step 1. Navigate to the Employee tab on the Fiori Application.

Step 2. Click to open the My Tax Withholding application.

Step 3. Click the North Carolina tab.

Completing the Form

The following steps explain how to maintain the information on the North Carolina Employee’s Withholding Allowance Certificate (NC-4) form. There are 3 steps to complete this process.

Note: If you are making an in/out state change, please ensure your address information is also updated.

Note: The following process can also be used for the Federal (W-4) or other state withholding forms.

1. Click Edit to make changes.

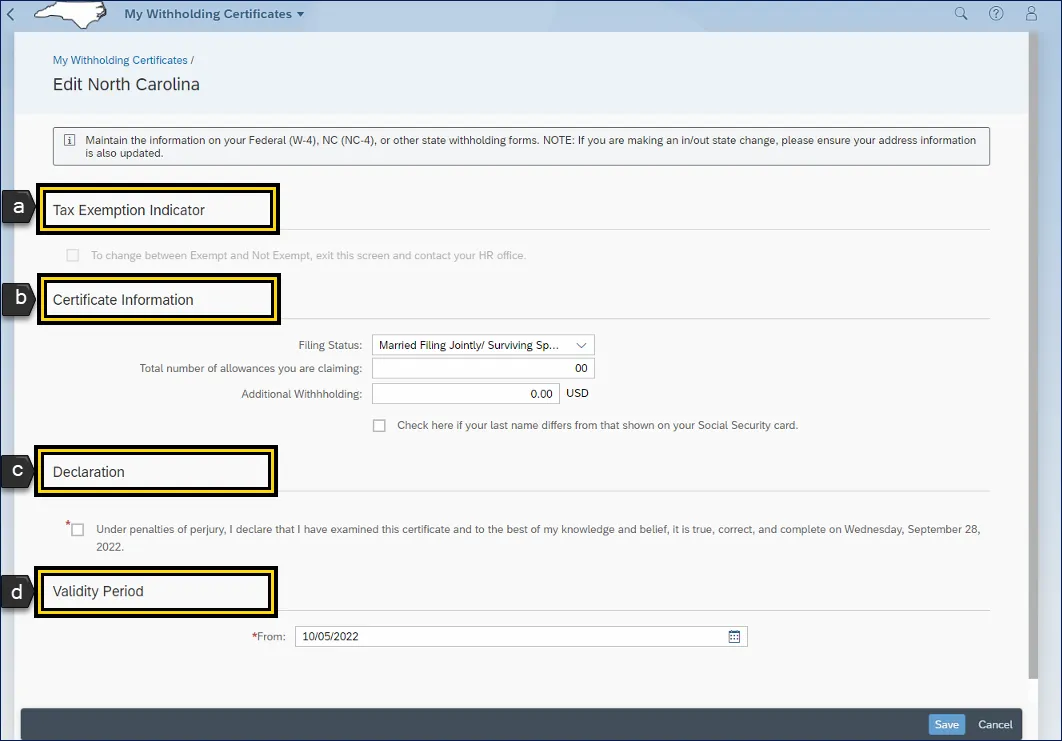

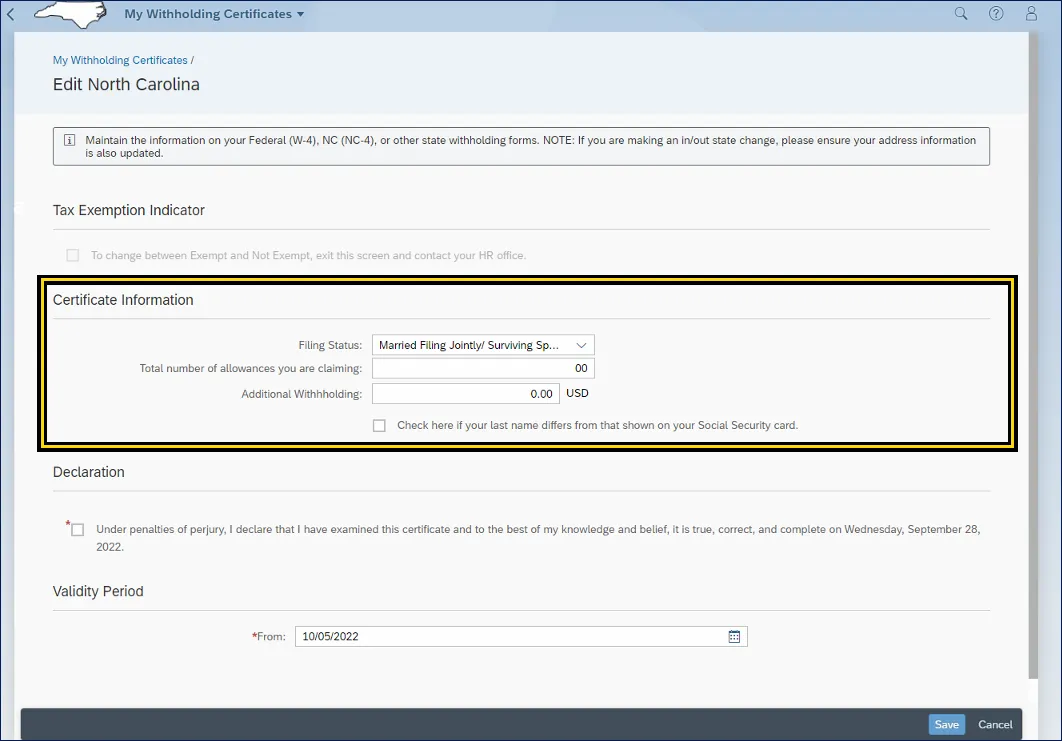

2. There are four areas within the North Carolina (NC-4): Tax Exemption Indicator, Certificate Information, Declaration, Validity Period.

NOTE: Address information should be updated if making an in/out of state change. Notify your HR Representative if you are making an in/out of state change.

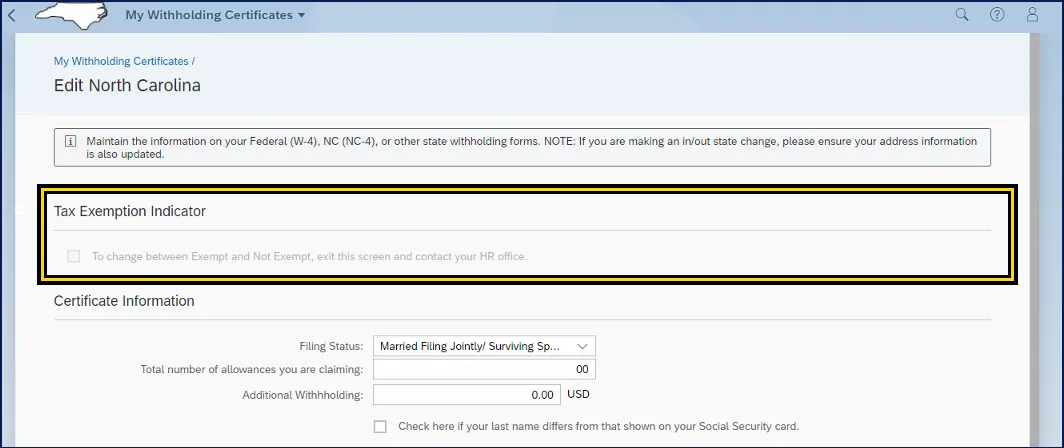

a. Tax Exemption Indicator

i. This area is grayed out and cannot be modified by the employee.

ii. The grayed-out information states “To change between Exempt and Not Exempt, exit this screen, and contact your HR office. “

Note: Employees must contact their HR office to change between Exempt and Non-Exempt.

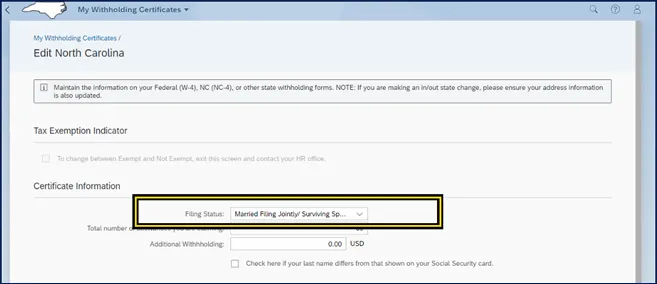

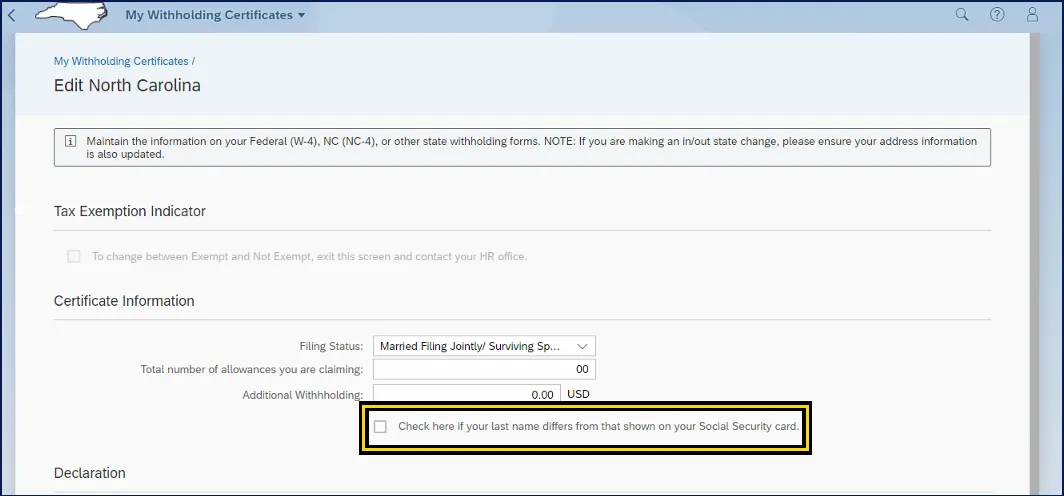

b. Certificate Information

i. Certificate Information area can be edited by the employee. Employees can use the NCDOR forms as all fields are mapped with the same field titles.

Note: These forms can be accessed on the Personal Data card within the My Reports & Resources application.

ii. Select the dropdown box for Filing Status to select the appropriate filing status from the available options: Single or Married Filing Separately; Married Filing Jointly/ Qualifying Widow; Head of Household.

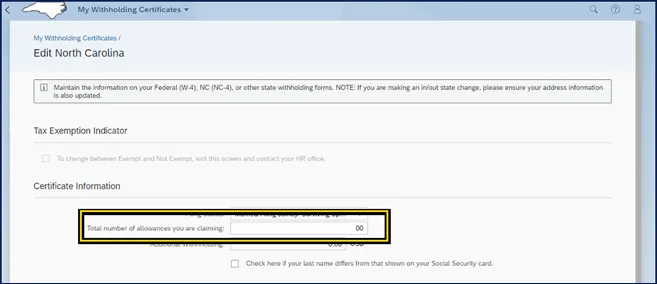

iii. In the Total number of allowances, you are claiming field, enter the number of allowances.

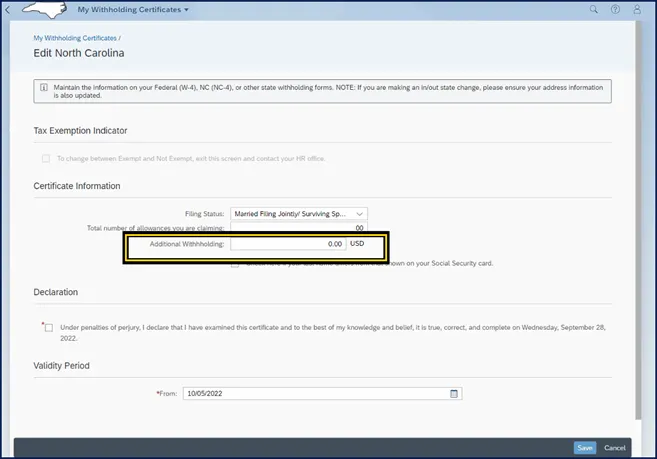

iv. Click the field Additional Withholding to enter any additional tax you want withheld each pay period.

v. If your last name appears differently on your security card than the name displayed in the top header of the Tax Withholding, click the check box below the Extra Withholdings selection.

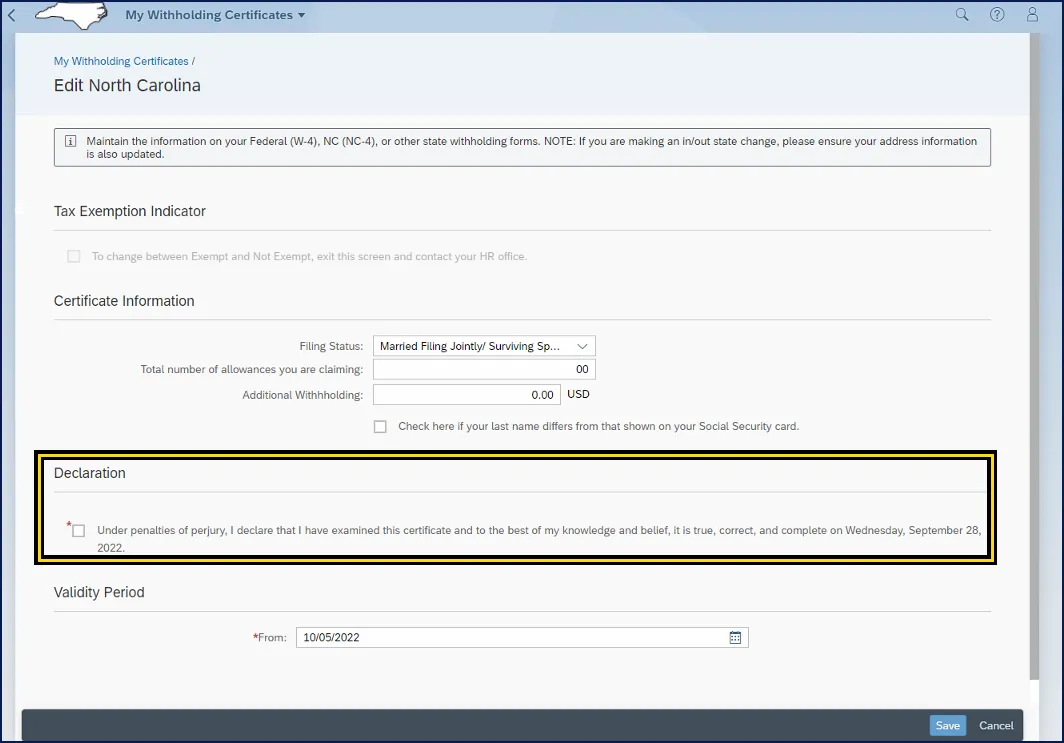

c. Declaration

i. The employee must check the checkbox to declare the information placed in the Certificate information is true and correct.

Note: The Declaration field is required when there has been a change in the Certificate information. The checkbox must be checked for the changes to be saved.

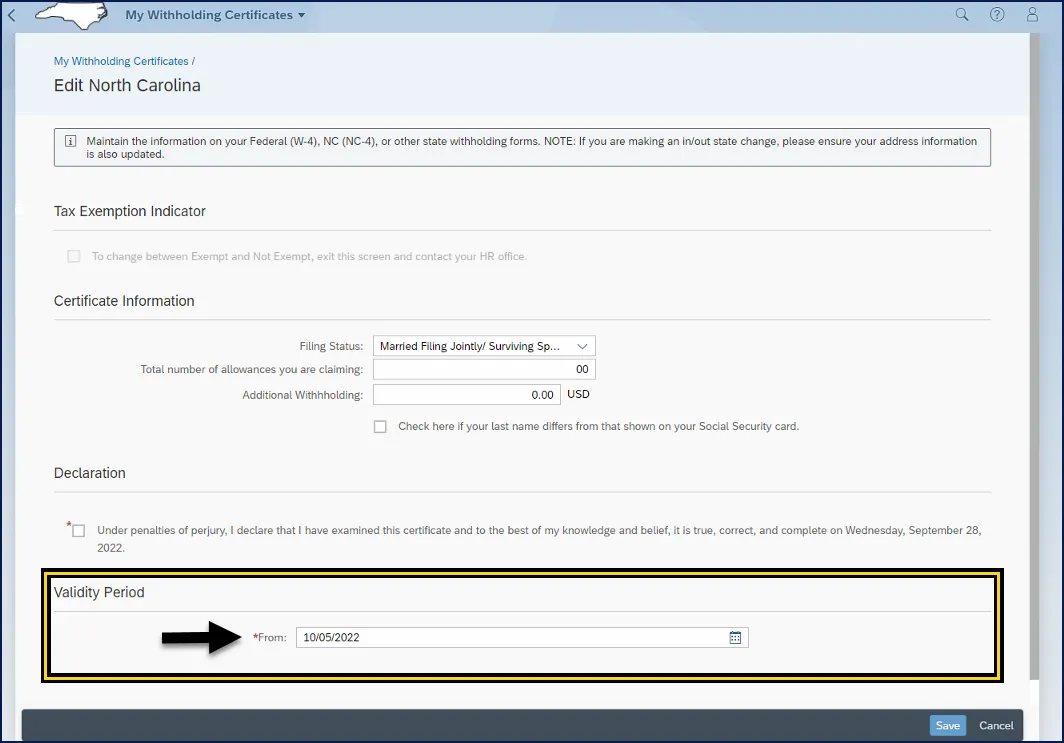

d. Validity Period

i. The default date displayed is future dated by a standard defined date from today’s date.

ii. Select any future date after the defaulted displayed date for the changes to take effect. The future date must be at least seven days from today’s date.

Note: Do not enter a date that occurs before the default date. If a date is selected that occurs before the default date, an error message will generate.

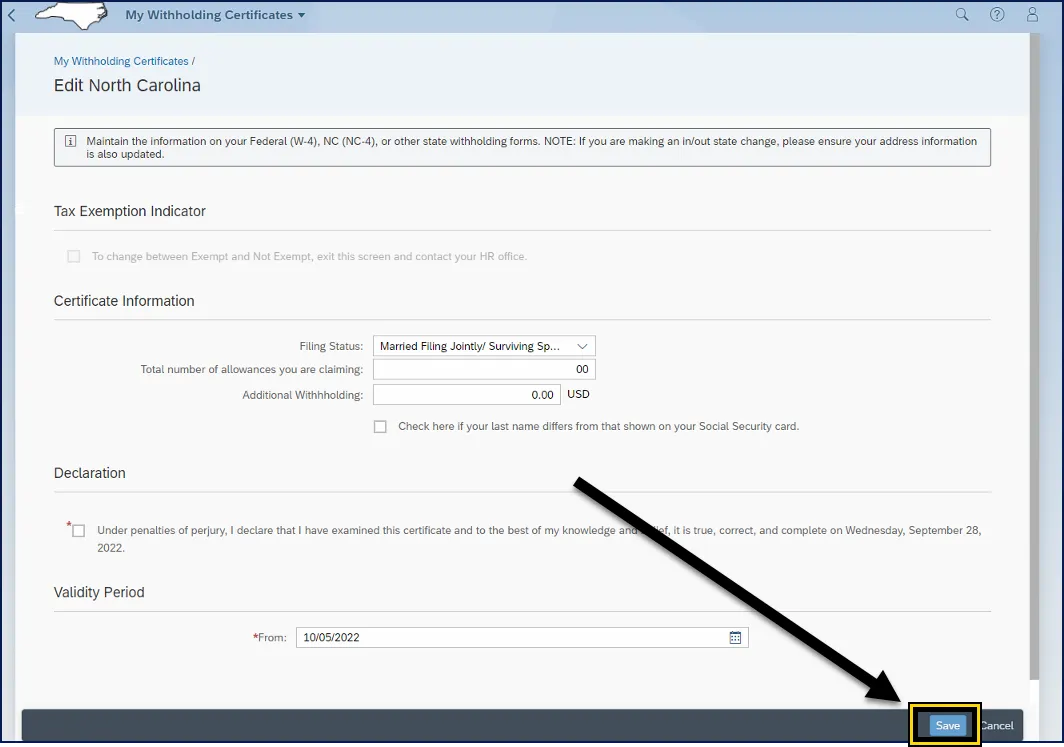

Step 3. Click Save once all modifications have been entered, the declaration checked, and the validity period selected.

Additional References

Users can use the Help? feature available within all Fiori applications.

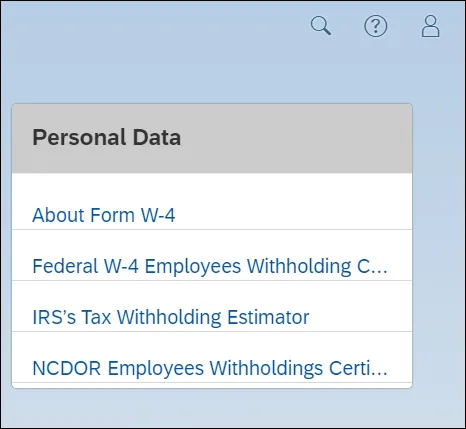

Additional Help documentation, such as the Federal W-4 Employee Withholding Certificate, About Form W-4, or NCDOR Employees Withholdings Certificate can be accessed from the My Reports & Resources My Personal Data card.